Stablecoins are among crypto’s fastest growing use cases

Stablecoins regularly see hundreds of billions of dollars in monthly trading.

There’s never a dull moment on the blockchain. Here’s what you need to know this week:

Bitcoin notched $68K. Plus, BTC ETF inflows surged, and Kamala Harris commented on crypto regulation.

How stablecoins became a “killer app” for crypto. From U.S. based fintech firms to emerging markets around the world, stablecoin use is on the rise.

This week in numbers. The total value locked on Base, the number of monthly active addresses across the entire crypto space, and more key stats to know.

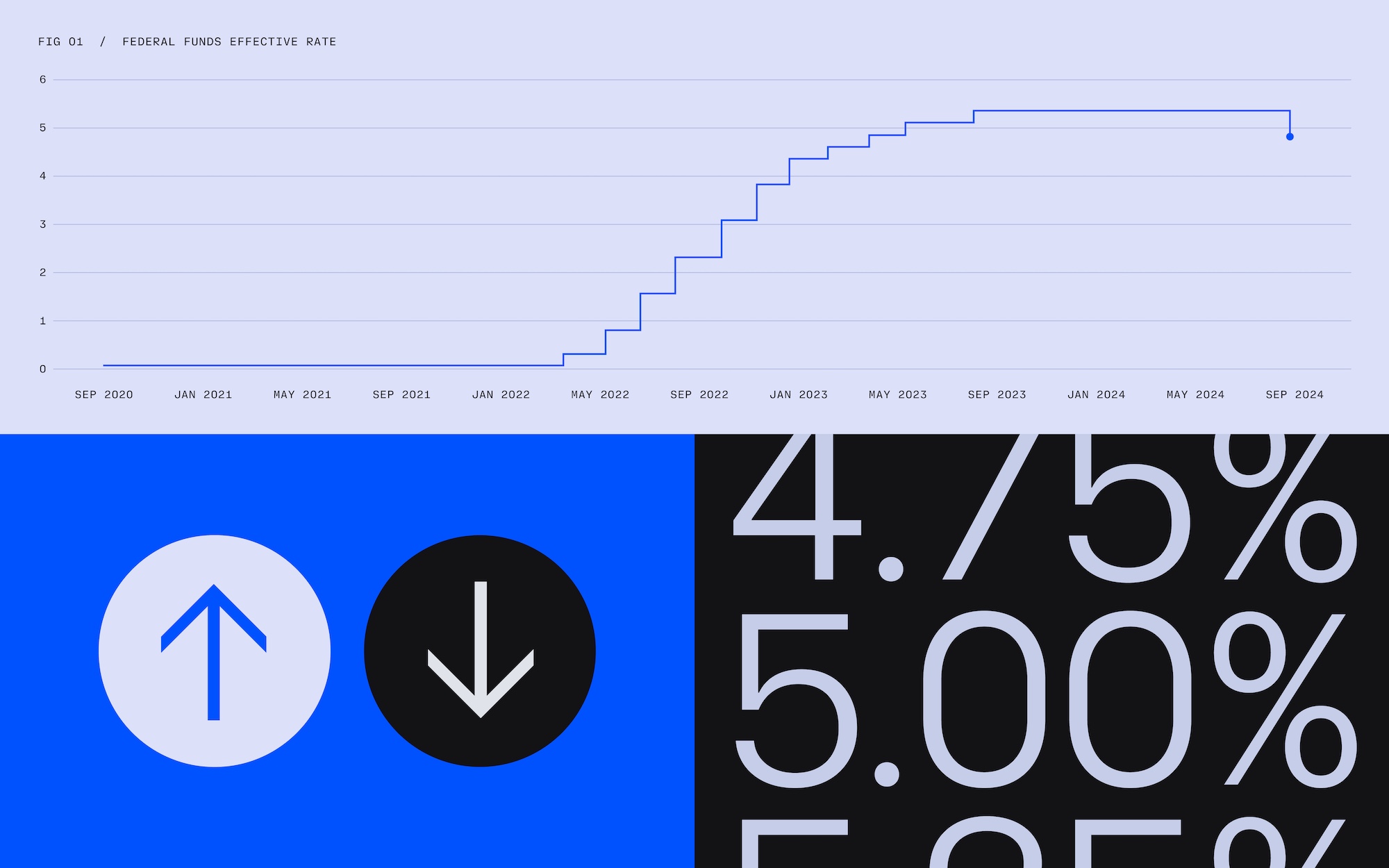

MARKET BYTES

As BTC rallies, is “Uptober” finally here?

For the first time since July, bitcoin crossed the $68,000 mark on Wednesday morning after waves of bullish news pushed markets upward to start the week.

With major U.S. banks reporting blockbuster earnings, stock markets nearing record highs, and both presidential candidates reaching out to crypto voters, prices for BTC, ETH, DOGE, and most other major tokens were up by midweek. Crypto-related stocks also got a big boost.

So, does this all mean that “Uptober” has finally arrived? October has averaged 20% gains for BTC over the last decade, according to Bloomberg, and as one analyst noted, “Historical data suggests that October’s seasonal strength in crypto markets is typically weighted toward the latter half of the month.”

Here are three more market stories you should know about…

Spot BTC ETF inflows surge; BlackRock CEO talks future

On Monday, the twelve U.S.-based spot BTC ETFs had their biggest day since early June, notching a combined $556 million in inflows, according to Bloomberg data. But as BlackRock CEO Larry Fink sees it, we’re still in early days for crypto as an asset class.

“Years ago, when we started the mortgage market … [it] started off very slow but it built as we built better analytics and data,” Fink said during the firm’s earnings call on Monday. “Through better analytics and data, more acceptance and a broadening of the market [occurred]. I truly believe we will see a broadening of the market of these digital assets.”

ETH too? While BlackRock’s BTC ETF is a blockbuster success, having grown to $162 billion since launching in January, the firm’s ether fund remains significantly smaller. But Fink is bullish on ETH. “We believe the technology of these blockchains is going to become very additive,” he said. “Then you will overlay AI, and having better data analytics, the applicability and the broadening of these markets will occur… Ethereum as a blockchain can grow dramatically.”

Kamala Harris addresses crypto on the campaign trail

Crypto has emerged as a major issue in the 2024 presidential election, and as a recent Coinbase report noted, voters who care about crypto could play a key role in swing states and beyond.

Both candidates have tried to appeal to this constituency. This summer, for instance, former President Donald Trump appeared at the Bitcoin Conference in Nashville and pledged to make the U.S. the “crypto capital of the planet.”

This week, Vice President Harris announced that she would support rules that “will make sure owners of and investors in digital assets benefit from a regulatory framework.”

What voters really think… When it comes to crypto policy in the U.S., a majority of voters are thinking beyond party lines. According to Coinbase’s latest State of Crypto report, 73% of survey respondents said that crypto and blockchain legislation should be non-partisan, and the same share said that both parties should back crypto-friendly legislation.

Ethereum’s co-creator pitches network upgrades

Like BTC, ETH saw significant gains this week. But unlike bitcoin, which has been hovering about 10% shy of its all-time high, ether is nowhere close to that, sitting some $2,000 below its 2021 peak of $4,878.

Two years ago, the Ethereum blockchain saw a massive upgrade that shifted it from a “proof of work” blockchain like Bitcoin to a speedier, less energy-intensive “proof of stake” blockchain. In a new post on his website, Ethereum co-creator Vitalik Buterin outlined his vision for the network’s continued evolution.

Vitalik says… Speeding up transaction times, making the network more resistant to bad actors, and lowering the minimum staking requirement for validators from 32 ETH to just one ETH, are among the areas he’s exploring. “Poll after poll repeatedly show that the main factor preventing more people from solo staking is the 32 ETH minimum,” Buterin said. “Reducing the minimum to 1 ETH would solve this issue, to the point where other concerns become the dominant factor limiting solo staking.” (You don’t have to become a full validator to earn staking rewards.)

STABLECOIN SPOTLIGHT

How stablecoins became one of crypto’s fastest-growing use cases

Stablecoins — or crypto tokens pegged to the value of a reserve asset like the U.S. dollar — have been an essential component of the crypto ecosystem since they launched a decade ago.

But in 2024, stablecoins have taken off in a major, mainstream way, with tokens like USDC emerging as a technology underpinning a fast-growing portion of global commerce. According to a new “State of Crypto 2024” report from venture firm (and Coinbase investor) a16z, stablecoins account for a third of crypto user activity and, per a Castle Island report, regularly clock hundreds of billions of dollars in monthly trading volume.

Many of the world’s biggest banks and fintech firms are increasingly turning to stablecoins for cross-border payments; citizens in emerging markets are flocking to them as a hedge against inflation; and regulators are recognizing the need to catch up.

Here’s what you need to know.

Payment giants Stripe, PayPal, and Visa all expand into stablecoins

Stripe, the second-largest online payment processor, relaunched crypto payments in the U.S. for the first time since 2018 last week. Within a day, users from more than 70 countries made purchases using USDC, which is the second-largest stablecoin by market cap.

Stripe users can now pay with USDC on Ethereum, Solana, and Polygon, with merchants automatically receiving USD in their accounts. The feature is currently only available to merchants in the U.S., but is expected to be rolled out internationally in the coming months.

Meanwhile, PayPal, the largest online payment processor, has been experimenting with using its own PYUSD stablecoin for business transactions. And Visa, which is the largest payment processor overall, is launching a platform to allow global banks to mint, burn, or transfer their own stablecoins or other tokenized assets.

Stablecoins are becoming a safe-haven in Latin America

As new reports from a16z and Chainalysis illustrate, people in developing economies are increasingly turning to stablecoins as a safe-haven from often rampant inflation.

In Argentina, which has experienced triple-digit inflation for years, residents have utilized stablecoins as a way to protect their savings and create economic stability. Stablecoin usage has spiked in Argentina over the past two years and now represents 62% of all crypto transactions there, well above the global average of 45%.

Venezuela, which has also suffered from persistently high inflation, has seen 110% year-over-year growth of crypto adoption since 2022, with much of it driven by residents looking for alternatives to their local currency.

Africa and Asia are increasingly relying on stablecoins too

Around 70% of countries in Africa are dealing with a foreign exchange crisis, according to Castle Island’s report. For businesses, that means international payments are difficult, or even impossible, severely limiting businesses’ ability to buy goods or services from abroad. As a result, stablecoins have emerged as a critical engine to support local economies.

Nigeria has among the highest stablecoin adoption rates in the world. Around 48% of survey respondents said they primarily use stablecoins to buy or sell goods and services; 46% said they hold a quarter or more of their portfolios in stablecoins, and 77% said they’ve converted their local currency into stablecoins at least once.

In Indonesia, the Castle Island report notes, stablecoin adoption has been driven by the relative ease of access in comparison to trying to create a USD-based bank account. Instead of being limited to banking hours and minimum or maximum transfer limits, Indonesian users can transact via stablecoins with as little as $1, and with almost no maximums.

The U.S. could be inching closer toward stablecoin regulations

This week, Sen. Bill Hagerty (R-TN) is expected to propose a bill that would establish a federal regulatory structure for stablecoins. Among other things, the bill — which builds on the Clarity for Payment Stablecoins Act, introduced by House Financial Services Committee Chairman Patrick McHenry (R., NC) — would exempt stablecoins with a market cap of less than $10 billion from federal oversight and allow such tokens to be overseen by state regulators.

While it’s not expected to pass this year, it could serve as a framework for conversations in the “Lame Duck” session of Congress (when Congress comes back to finish work after the election), or next year. It is the latest sign that calls for comprehensive crypto regulations are gaining momentum in Washington.

The bottom line…

The market for tokenized assets like stablecoins could grow to $5 trillion in 2030, according to research from Citigroup, and stablecoins are on track to become one of the biggest drivers of mainstream crypto adoption.

As a16z put it in their report, “By enabling fast, cheap, global payments, among other uses, stablecoins have become one of crypto’s most obvious ‘killer apps.’”

NUMBERS TO KNOW

$2.49 billion

Value of funds deposited on Base, eclipsing Arbitrum and making it the top Ethereum Layer 2 blockchain by total value locked (TVL) according to data from DeFiLlama. The Coinbase-incubated L2’s funds are distributed across 350 connected protocols, but DeFi protocol Aerodrome makes up the lion’s share, with more than $1.3 billion in deposits.

220 million

Number of monthly active crypto addresses across more than 20 blockchains including Bitcoin, Ethereum, Solana, and Base — an all time high according to a16z’s latest State of Crypto report. While one active address doesn’t necessarily correspond to one person, the metric is helpful in understanding the general scale of the crypto ecosystem.

99%

The percentage reduction in Ethereum transaction costs since 2021, thanks to Ethereum scaling solutions (such as L2 blockchains like Base). As a16z’s report notes, it cost an average of $12 to send USDC via the Ethereum mainnet 2021, compared to less than a penny in September using Base.

SECURITY PSA

Protecting the elderly and vulnerable from scams

Crypto security is always a top priority, and it’s important to keep ourselves and our loved ones educated and aware of how to identify common theft patterns. Many older Americans fall victim to financial scams when they are alone and out of contact; retired Americans and others over 60 are common targets for scammers, especially with Social Security and investment fraud.

Read our latest blog post for tips on identifying two examples of frequent fraud schemes.

TOKEN TRIVIA

What percent of Americans between the ages of 18 and 34 own crypto?

A

5%

B

15%

C

25%

D

35%

Find the answer below.

Trivia Answer

C

25%