What crypto voters care about

95% of crypto owners who are eligible voters are likely to vote this November, according to recent polling.

There’s never a dull moment on the blockchain. Here’s what you need to know this week:

Bitcoin slipped to $60K to start October. Plus, the latest headlines about ETF inflows, mining profits, and blockchain activity.

How crypto became an essential election issue. Breaking down the key findings from Coinbase’s latest State of Crypto report.

This week in numbers. The amount of VC funding raised for crypto projects this year, the value of BlackRock’s BTC ETF, and more stats to know.

MARKET BYTES

Bitcoin had a historically strong September, despite this week’s dip

September has historically been crypto’s slowest month — but not this year! Even though prices dipped to start the week, BTC was up nearly 8% for the month — reaching as high as $66,000 last Friday — in what turned out to be the strongest September since 2013.

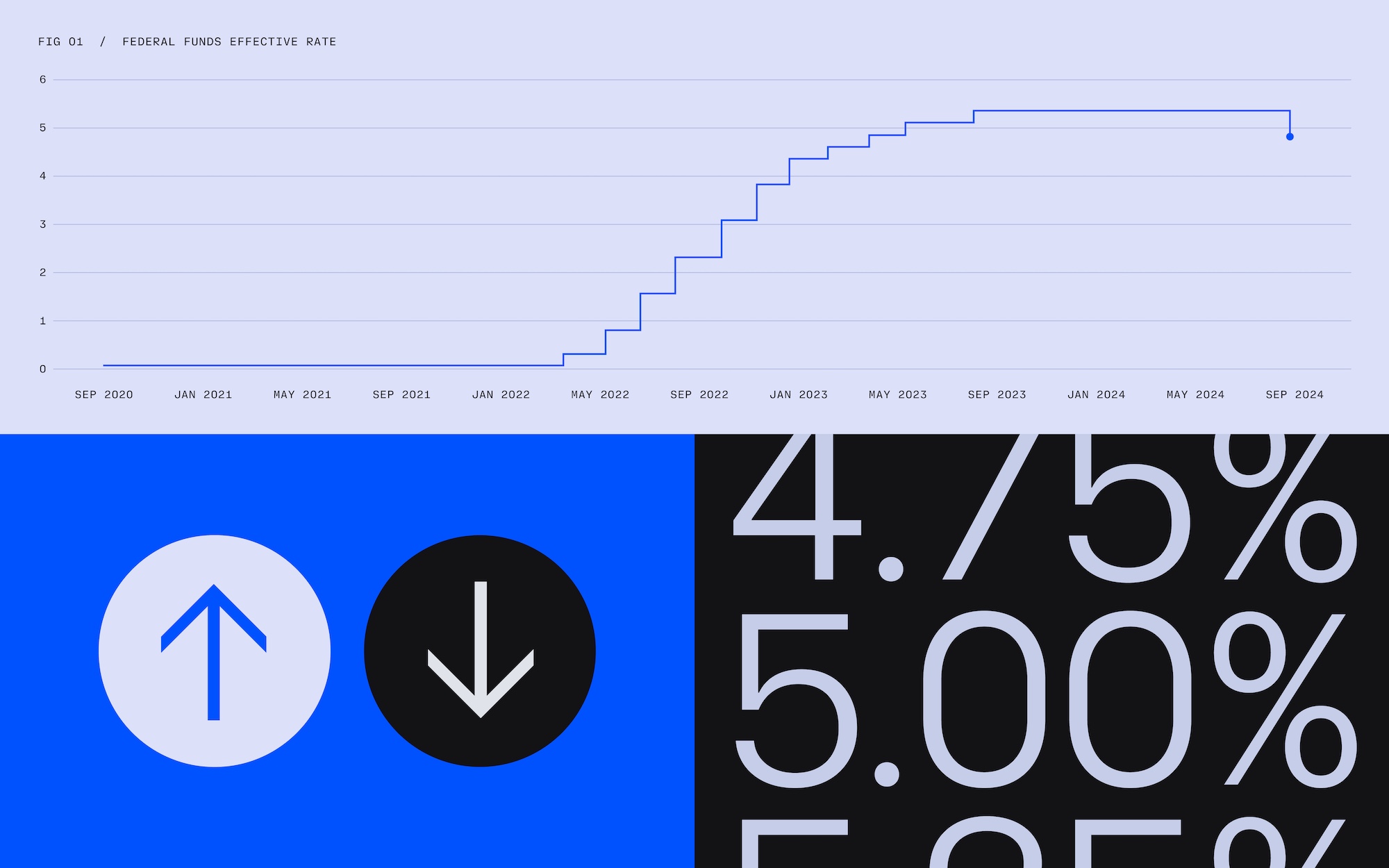

What spooked markets? One factor was likely the expiration of $5.8 billion in crypto options on Friday. Prices dipped Monday on news including Federal Reserve Chair Jerome Powell hinting that further interest rate cuts might not be as large or frequent as traders are expecting; mixed economic data, and increased geopolitical tensions around the world. By Wednesday morning BTC rebounded above $62,000 and Ethereum hovered around $2,450.

Here are three more market stories you should know about.

BTC ETFs recorded major inflows

Last week, spot bitcoin ETFs from firms including BlackRock and Fidelity notched more than $1 billion in inflows — the strongest week since July. Spot Ether ETFs also scored their second-best week since launching this summer, although they remain far behind BTC ETFs in size.

But as BlackRock’s head of digital assets notes, the firm’s $1 billion-plus ETH fund (ETHA) would be considered a huge success in most other contexts: “In most cases, it takes multiple years to never for a new ETF to get to a billion.”

I want my ETF.… Market watchers attribute some of the increased crypto ETF activity to institutional traders warming to the asset class as they take advantage of interest rates declining in the U.S. and the Chinese government launching a $278 billion stimulus plan. In Japan, new crypto legislation could also drive adoption via lower taxes and the launch of crypto ETFs there.

Blockchain activity is up

Activity on the Ethereum blockchain ramped up in the second half of September, according to a new Coinbase report, with ETH fees surging alongside onchain activity. Meanwhile, the total value locked (TVL) on the Base blockchain has broken $2 billion for the first time, up from around $430 million at the start of the year.

DEX effect… Decentralized exchange (DEX) activity on both chains seems to be a major driver of transaction activity. On Base, the Aerodrome DEX alone makes up more than half of the blockchain’s TVL. For Ethereum, DEX activity was up 9% on Friday compared to the previous week.

Bitcoin mining profits have been down for three straight months

Despite rising bitcoin prices in September, BTC miners saw daily profits sink to the “lowest on record,” according to a new report from JPMorgan. The dip came in the midst of three straight months of declining profits and rising hashrates (a measure of the computational power required by the network).

Pivot to AI… Meanwhile, an increasing number of mining firms are redeploying some of their computational power to AI. One such firm, Hive Digital, has repurposed Nvidia graphic processing units (GPUs) it once used for Ether mining — earning up to $1 an hour per GPU, compared to around $0.12 for crypto mining. “Institutions are much more interested in us with our AI than Bitcoin,” said the firm’s chairman.

COINSTITUENCY

Why crypto has become a key election issue in 2024

As the 2024 presidential election approaches, crypto has emerged as an important issue, with crypto voters poised to play a major role in swing states and beyond. As a result, both candidates have stepped up their overtures to this constituency.

Vice President Kamala Harris, the Democratic candidate, said that her administration would “encourage innovative technologies like AI and digital assets while protecting our consumers and investors.”

Former President Donald Trump, the Republican nominee, has also voiced his support for crypto, saying he wants the U.S. to be the “crypto capital of the planet.”

But who are “crypto voters” and what do they care most about? Coinbase’s latest State of Crypto report, which includes new Morning Consult data commissioned by Coinbase, set out to answer those questions and determine the potential impact of crypto in next month’s elections.

Here’s some of what was discovered…

1. Crypto owners are diverse

Crypto owners aren’t just “crypto bros.” They’re demographically diverse, and consist of a wide range of ages and socioeconomic backgrounds.

Sixty eight percent of crypto owners are Gen Z or Millennials, with nearly half being non-white, and 70% earning less than $100,000 annually. And they reach across political lines: An equal share of crypto voters (47%) said that they intend to vote for Kamala Harris and Donald Trump, contradicting media portrayals of crypto owners largely leaning Republican or libertarian.

2. Crypto voters want clear regulations

The U.S. has lagged behind many other developed economies in implementing comprehensive crypto regulations. And crypto voters have noticed, with 74% of respondents saying there should be clearer crypto regulations, and 75% of respondents noting they believed such regulations would be good for the economy.

Notably, the majority of crypto owners surveyed also said they’d consider more involvement in the industry if elected representatives and the U.S. president showed support for pro-cryptocurrency regulations.

3. Crypto voters believe crypto policy should be non-partisan

Many current political issues fall along partisan lines. But crypto voters believe that crypto policy shouldn’t suffer from the same divisions, with 73% of respondents saying that crypto and blockchain legislation should be non-partisan. The same share of respondents also said that crypto-friendly legislation should be backed by both parties.

4. Crypto could be a decisive issue in battleground states

Approximately 52 million Americans owned crypto in 2023 — and around 1 in 8 live in the seven swing states that will likely be key to the outcome of the 2024 presidential election.

There are approximately 1.4 million crypto owners in Pennsylvania, 1.3 million in Georgia, 1.1 million in North Carolina, 940,000 in Michigan, 720,000 in Arizona, 640,000 in Wisconsin, and 385,000 in Nevada.

The bottom line…

With the presidential election this November likely to be decided by a narrow margin, the result could come down to a handful of voters in the most competitive states. Could crypto voters be a determining factor? It’s possible. Consider this: The estimated 52 million Americans who owned crypto last year equals seven times the national vote differential in the 2020 presidential election.

NUMBERS TO KNOW

$25 billion

The value of the bitcoin in BlackRock’s BTC ETF (IBIT) on Sunday, a new all-time high following several weeks of positive inflows into the world’s largest spot bitcoin fund.

$2.2 billion

Amount of venture capital raised for crypto projects in 2024, as of July. According to Forbes, the pace of funding is on track to exceed the $2.6 billion total from 2023. Among the top categories receiving VC attention are decentralized physical infrastructure, real-world asset tokenization, and Bitcoin-scaling solutions.

$1 billion

Total amount that has been wagered so far on the outcome of the U.S. presidential elections via Polymarket, the buzzy crypto-powered predictions market that allows users to trade the odds on real-life events.

107

Amount of BTC (about $6.9 million) that Japanese investment firm Metaplanet added to their balance sheet, bringing their total bitcoin holdings to more than 500 BTC. In April, the firm announced a “strategic pivot” to make BTC its core treasury asset, following the lead of the top corporate BTC holder, MicroStrategy.

SECURITY 101

Why crypto's an ally for law enforcement, not criminals

The notion that cryptocurrency is synonymous with criminality... is a myth. Recent estimates indicate that only 0.34% of all blockchain transactions are associated with illicit activity. Compare that with cash: It's estimated that 33% of cash in circulation is used by criminals, including tax evaders, in the United States.

Learn more about why crypto is not the preferred tool for criminals, but is instead a powerful ally for law enforcement.

TOKEN TRIVIA

What is a wrapped token?

A

Cryptocurrency that you gift someone for the holidays

B

A type of cryptocurrency that mirrors the value of another cryptocurrency from a different blockchain

C

A type cryptocurrency that maintains a peg to a reserve asset, typically the U.S. Dollar.

D

The cryptocurrency miners receive as a reward for verifying transactions on a blockchain

Find the answer below.

Trivia Answer

B

A type of cryptocurrency that mirrors the value of another cryptocurrency from a different blockchain