Bitcoin and the Fed’s rate cut

The day after the Federal Reserve announced a 0.50% interest-rate cut, BTC passed $63,000.

Editor’s note: This newsletter originally misstated the relationship between Ripple and XRP / XRP Ledger. The web-version has been updated.

There’s never a dull moment on the blockchain. Here’s what you need to know this week:

Bitcoin crossed $63K after the Fed’s rate-cut decision. Plus, a closer look at ETH’s recent price struggles, BTC mining profits, and crypto ETF action.

Is XRP poised for a breakout? After several years of setbacks, a flurry of recent developments have caught some market watchers’ attention.

This week in numbers. The value of stablecoin transactions in the first half of 2024, MicroStrategy’s latest BTC purchase, and more stats to know.

MARKET BYTES

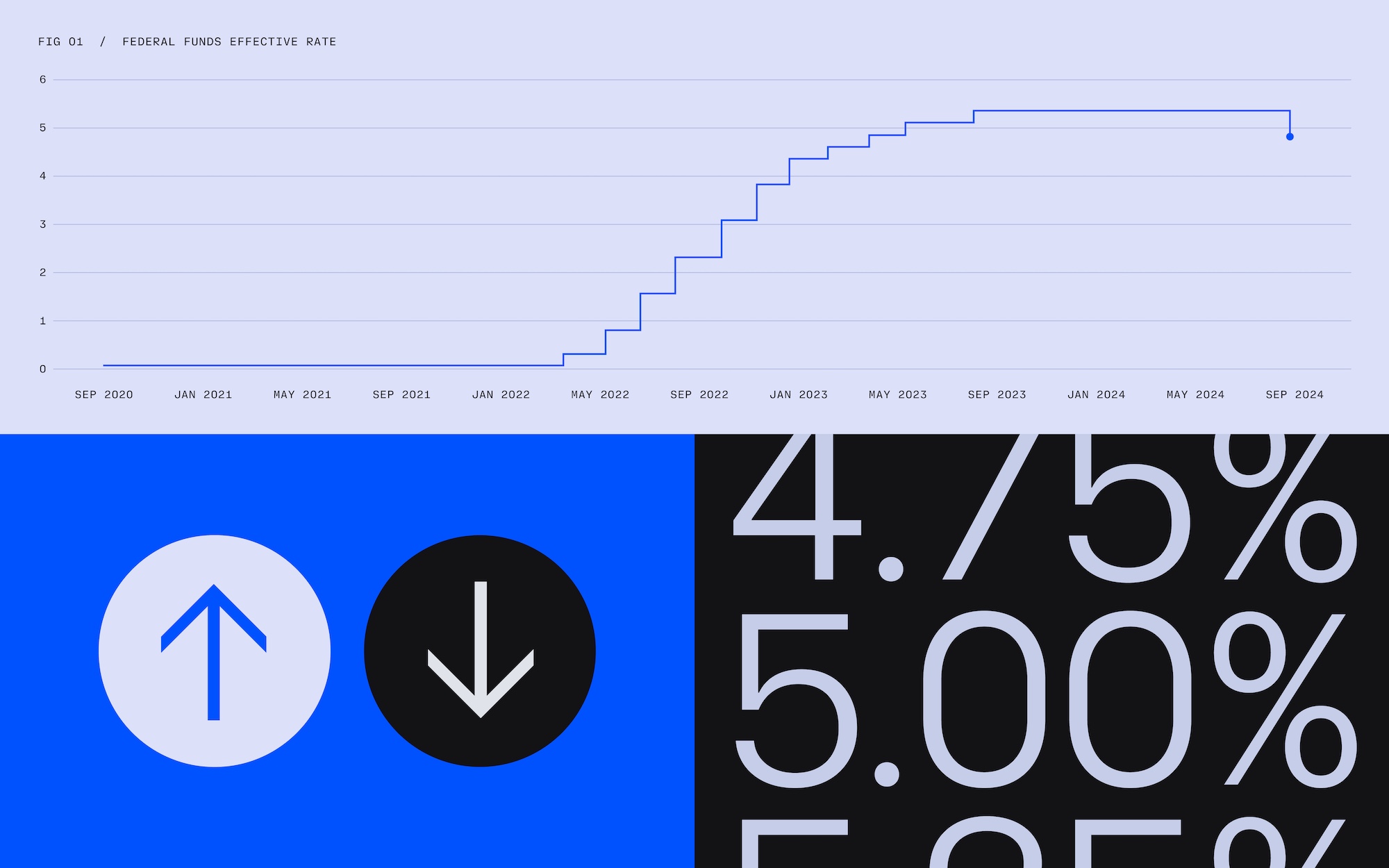

The Fed cuts interest rates for first time since 2020

On Wednesday, the U.S. Federal Reserve chose to cut interest rates by half a percentage point, the first such reduction since the central bank began increasing rates in an effort to tame decades-high inflation following the global pandemic.

The central bank’s 0.50% rate-cut was more than the 0.25% cut some analysts had predicted, settling a weeks-long debate among analysts and investors about the Fed’s next move. In a statement, the Fed noted that “the committee has gained greater confidence that inflation is moving sustainably toward 2%, and judges that the risks to achieving its employment and inflation goals are roughly in balance.”

Rate cuts are generally seen as a bullish signal because the combination of cheaper borrowing and lower returns on cash holdings tend to mean more capital ends up in asset classes like stocks and crypto.

In the days before the announcement, as traders anticipated the news, BTC climbed as high as $61,335.83. In the immediate aftermath, crypto prices remained relatively flat — potentially indicating the cut had been “priced in” by markets. By the following morning, however, Bitcoin had ticked above $63,000.

Here are three other market stories you should know…

Why has ETH been underperforming other major tokens?

In recent weeks, crypto markets have mostly lagged behind other asset classes, including stocks. But even by that standard, ETH has been struggling more than other major cryptocurrencies, despite the launch of spot ether ETFs from BlackRock, Fidelity, and others this summer.

This week, ETH hit a 41-month low against BTC. It also has seen four consecutive months of falling prices against the U.S. dollar, sinking from around $3,900 in late May to below $2,300 in mid-September.

What’s eating at ETH? According to a new Coinbase Institutional report, market watchers have identified several potential culprits. One major thesis (that the report is skeptical about) is that activity on Ethereum layer 2 blockchains surged following ETH’s last major upgrade in March, leading to reduced traffic and fees on Ethereum’s mainnet. Bitwise CIO Matt Hougan suggests that ETH’s currently low prices could represent a good “contrarian bet” through the end of 2024. “None of Ethereum’s challenges seem existential, and its opportunities are brimming,” Hougan said. “I suspect the market may reevaluate Ethereum as we get closer to the November elections and any regulatory clarity that emerges.”

Computing power on Bitcoin’s blockchain is at an all-time high, but miners are seeing slimmer profits

According to a new JPMorgan report, the BTC mining network’s hashrate (a measure of the network’s collective computing power) has risen for five consecutive months, and is now at its highest level ever.

At the same time, factors including April’s halving have made it harder for miners to earn a profit, with the network’s daily profitability sinking to around 50% of pre-halving levels.

As a result, “Bitcoin miners are getting hammered by Wall Street,” CNBC reports. “Marathon Digital is down nearly 30% in 2024, while Riot Platforms has fallen 53%. The price of bitcoin, meanwhile, is up about 44% this year.”

But mining firms say they’re well-positioned to weather this cycle. Speaking to CNBC, Marathon’s CEO pointed to efficient processors that allow the firm to double hashrates without an increase in energy usage.

Pivot to AI? One major mining firm, Core Scientific, has thrived on Wall Street even as peers have struggled, in part because it has redirected some processing power to AI. “Our facilities were developed to be multi-use for not only just bitcoin mining, but also for the transition that we’re doing right now to high-performance computing,” said the company’s CEO.

BTC ETFs rallied in advance of interest-rate announcement

After recent struggles that culminated in their worst week since launching in January, spot BTC ETFs surged back to life in recent days as traders anticipated the Fed’s rate cut.

Fund facts… Spot BTC ETFs grew by around $250 million on Monday, their biggest day in more than a month, according to data from Arkham Intelligence. Crypto investment products overall saw inflows of $486 million last week, per a CoinShares report that came out on Monday. Among non-BTC tokens, ETH funds declined by around $19 million while SOL funds gained around $3.8 million.

RIPPLE EFFECT

Is XRP finally poised for a breakout?

The cross-border payment token XRP has quietly been one of the biggest cryptocurrencies by market cap for a decade, but now, after several years of setbacks, some market watchers say that it could be poised for a breakout.

Since crypto technology firm Ripple’s 2023 legal victory in a lawsuit brought by the SEC over its sale of XRP, one of Wall Street's top crypto-focused firms has launched an XRP fund, and XRP’s network has seen a flurry of development, including a forthcoming stablecoin.

Markets are paying attention: The token, which hit lows below $0.40 in July, had climbed to $0.59 as of Thursday.

Here's what you need to know…

What are Ripple and XRP?

XRP Ledger blockchain and its native XRP token were launched in 2012 and are designed to work together as a fast, cheap, and scalable peer-to-peer global payments system. Ripple (formerly Ripple Labs) is a blockchain technology company that uses XRP in its cross-border payment network. Unlike most cryptocurrencies, XRP is pre-mined and has a maximum supply of 100 billion tokens.

Why did the SEC sue XRP, and what was the result?

In December 2020, the SEC sued Ripple Labs, claiming that the company engaged in the sale of $1.3 billion worth of unregistered securities. (According to U.S. securities law, if an asset is a security, then it’s supposed to be registered with the SEC prior to sale.)

A judge ruled in July 2023 that XRP itself is not a security, and that sales of XRP to retail investors via crypto exchanges, for example, did not qualify as securities transactions. In the wake of the decision, crypto markets saw a major spike.

Ripple eventually paid a fine of $125 million in August 2024 to settle charges related to its sales to institutional investors. The fine effectively marked the end of the case, though the SEC does have until next month to file an appeal.

Grayscale launched an XRP trust last week

Within weeks of the lawsuit’s resolution, Grayscale, which is the world’s largest crypto-focused asset manager, introduced the Grayscale XRP Trust, its 19th crypto investment trust. The news saw XRP rise nearly 10% to around $0.59.

Similarly to ETFs, investors can buy shares in a trust, which represent the value of the underlying asset. But unlike ETFs, trusts have a fixed number of shares available, which can make them harder to trade.

The Grayscale XRP Trust will only be available to accredited investors for now. But the trust could pave the way for an eventual XRP ETF. (Grayscale’s Bitcoin and Ethereum trusts both ultimately converted into ETFs.) Earlier this year, Standard Chartered said it believes XRP will eventually have an ETF, by as soon as 2025.

Ripple is preparing to release its own stablecoin on XRP’s blockchain

The lawsuit’s conclusion has also paved the way for Ripple to plot the next stages of its growth, which includes a multi-chain stablecoin, RLUSD.

The token, which is already being tested for launch on XRP Ledger and Ethereum, will be aimed at institutional investors, in-line with XRP’s primary use case as a way for large financial institutions to send value across borders. RLUSD will be 100% backed by U.S. dollar deposits, short-term U.S. government Treasuries, and other cash equivalents, according to Ripple.

With the stablecoin market expected to reach as high as $4 trillion within five years, Ripple’s CEO Brad Garlinghouse says that RLUSD should serve “as a complement, or even an accelerant to what Ripple’s doing at its core.”

XRP Ledger might soon host smart contracts, too

Ripple is also expanding the use-cases of XRP and XRP Ledger through the introduction of Ethereum-compatible smart contracts. Initially, the smart contracts will only be usable on an adjacent blockchain, but they’re eventually expected to be integrated into the main XRP Ledger.

The rollout of smart contracts on XRPL would significantly expand its utility by enabling the development of decentralized exchanges, more simplified token issuance, and the automation of more complex financial transactions, akin to what’s available on many other blockchains.

The bottom line…

After years of legal battles, the coming months could represent a major reversal of trajectory for XRP. As Garlinghouse, Ripple’s CEO, put it: “As I’ve said before, with XRP having regulatory clarity in the U.S. and other countries, I expect it’s only a matter of time for this space to grow.”

NUMBERS TO KNOW

$2.6 trillion

The amount of value that stablecoin transactions settled in the first half of 2024, according to a new survey from Visa and asset manager Brevan Howard, among others. The report, which polled self-identified crypto users in India, Brazil, Nigeria, Turkey, and Indonesia, found that stablecoins were seeing a growing number of use cases in emerging markets, including currency conversion, payments, remittances, and salary.

$780 million

Approximate value of the 13,000-plus BTC mined by the Himalayan nation of Bhutan using hydropower resources. Bhutan currently has the fifth-largest BTC holdings of any nation in the world.

18,300

Number of BTC (worth roughly $1.1 billion) that MicroStrategy added to its balance sheet between Aug. 6 and Sept. 12. The software firm, which is the largest corporate holder of bitcoin, now has a total of 244,800 BTC (worth around $14 billion) — more than 1% of bitcoin’s total supply.

2

Consecutive years that India has led in the global adoption of cryptocurrency, according to an annual report from blockchain analytics firm Chainalysis. The Global Adoption Index, which measures growth across four categories in 151 countries, found that India ranked highly in both centralized exchange and DeFi usage.

TOKEN TRIVIA

What is dollar-cost averaging?

A

A gradual investment strategy that does not rely on “timing the market”

B

A method to automate crypto purchases on Coinbase

C

A way to invest any amount of money at regular intervals of time

D

All of the above

Find the answer below.

Trivia Answer

D

All of the above