ETH Price: $3,325.06

2.92% (1D)

The Ethereum (ETH) Merge is finally here!

Everything you need to know about The Ethereum Merge.

What is The Merge?

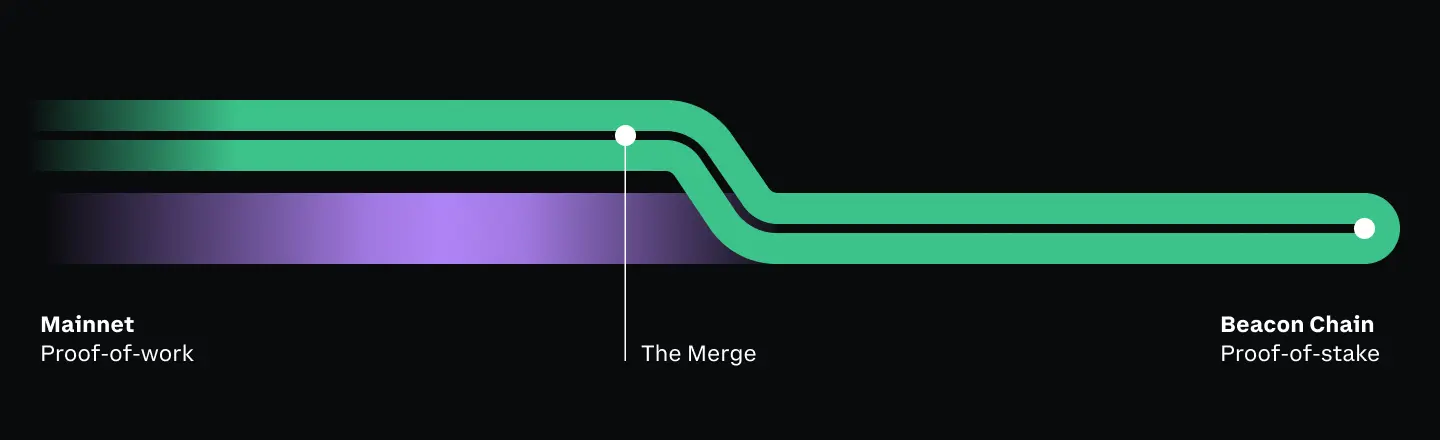

The Merge upgrade is Ethereum's long-awaited migration from its current "Proof-of-Work" consensus mechanism to a "Proof-of-Stake" system. The Merge actually happens in a two-step process, which have been named the Bellatrix & Paris upgrades. The Merge was officially kicked off by Bellatrix, which took place on Sept 6th 2022 at 11:34:47am UTC. Bellatrix is a network upgrade on the consensus layer. Bellatrix will be followed up by Paris, which will be the execution layer that will transition Ethereum from proof-of-work to proof-of-stake. Paris will be triggered by a specific Total Difficulty threshold, called the Terminal Total Difficulty (TTD), which makes the exact date of Paris TBD since it depends heavily on the proof-of-work hash rate. TTD is the total difficulty threshold required of the final block mined in Ethereum. In other words, TTD represents the fixed number of hashes that are left to mine until Proof-of-Stake officially takes over.

What happens immediately after The Merge?

Once complete, the already-running Beacon Chain will take over the process of validating new transactions through Proof-of-Stake and Ethereum's legacy Proof-of-Work model will be shelved permanently. To date, validators have already staked over 13 million ETH on the Beacon Chain. As the mainnet (the main network of the Ethereum blockchain) is merged with the Beacon Chain, the full transaction history of Ethereum, including every transaction, smart contract, and balance since July 2015, will also be merged.

Why is The Merge important?

The Merge is six years in the making and is considered by many to be a milestone in the history of cryptocurrency due to the potential material and philosophical implications. This milestone could also bolster market confidence and inject some much-needed optimism, after months of market volatility due to, among other factors, inflation and rising interest rates. As one commentator put it, Ethereum's Merge "will prove that a decentralized and permissionless network can operate in an energy-efficient manner." In addition, a merge like this is an incredibly rare event in crypto, and may never happen again.

How will The Merge impact me and my ETH?

The short answer is not much. The Merge is expected to be and should be seamless from a user's perspective. Coinbase will briefly pause some deposits and withdrawals as a precautionary measure, specifically new Ethereum (ETH), ERC-20, Polygon (MATIC), Optimism (OP), PWETH, PUSDC, and PMATIC tokens, but we otherwise do not expect any other networks or currencies to be impacted. However, for those who staked their ETH, balances will not be unlocked nor will they be available to trade or transfer immediately after The Merge. Staked ETH is expected to be unlocked and accessible once the Ethereum protocol completes its upgrades. Current estimates on this upgrade completion is early 2023. Stay tuned!

EXPECTED MERGE DATE

Sep 15, 2022

You've got ETH Merge questions. We've got answers.

We are officially at the finish line. After experiencing repeated delays due to the technical complexity of the undertaking, not to mention the vast amount of money that could be at risk, The Merge is finally here!

The exact Merge date is still very much in the air as we get closer and closer to the Terminal Total Difficulty (TTD). At this point, the exact date and time of The Merge is anyone's guess. But that hasn't stopped excitement surrounding The Merge from continuing to brew. Ethereum developers, including Tim Beiko, were unsurprisingly bullish and excited about the success of the Bellatrix upgrade. Now with the Bellatrix upgrade squarely in the rearview mirror, there is one final hurdle to overcome before The Merge is complete. Developers working on the project acknowledged their excitement last week, but not without also emphasizing what a big deal The Merge is, given what is at stake.

Ethereum's shift to Proof-of-Stake, which is projected to reduce energy consumption by 99%, makes strategic sense as a natural next step for Ethereum. This transition is not only highly anticipated, but is a welcome development as energy costs continue to surge across the world. Still, the move to Proof-of-Stake isn't without its detractors. There are legitimate counterarguments against Proof-of-Stake, namely that Proof-of-Stake could facilitate a high concentration of wealth among a small number of validators and that it could actually make the barrier to entry difficult to breach. But many believe that the pros ultimately outweigh the cons, especially in terms of the blockchains security and long-term scalability. Proponents argue that this move to Proof-of-Stake will make Ethereum more robust and decentralized. According to Buterin, Ethereum's upgrade aims to allow anyone to spin up an Ethereum validator, without the same capital and technical skills required of mining. That decentralization is extremely vital for Ethereum's base layer, and it would go a long way in protecting the longevity and future of the blockchain. If successful, this transition could, as at least one commentator has said, open the door for Ethereum and expand its use cases for the future.

What will The Merge mean for existing Coinbase users?

We expect no impact to trading across our centralized trading products. During any major event, including The Merge, it is critical that all users remain on high alert for scams. Your assets with Coinbase will be safe and secure during the transition period and there is no action required on your part to 'upgrade' your ETH.

Is there anything I need to do to prepare for The Merge?

The short answer is No. As users and holders of ETH, there is no action required to protect your funds or wallet entering and throughout The Merge.

How will The Merge impact Ethereum's price?

At this point, that's anyone's guess. Traders have speculated that prices can go both ways, i.e. some are expecting prices to soar, while others believe the opposite will happen. What is clear is that the market outlook for ETH post-Merge is not particularly clear cut, even after accounting for the potential of a deflationary monetary policy and higher developer activity on the blockchain. ETH issuance is expected to decline by 90%, and the total token supply could potentially decrease after burning and network activity are factored in. But it's unclear how much or whether that fact is already priced into Ethereum. Additionally, things could be more complicated if existing miners fork a Proof-of-Work chain from Ethereum's mainnet.

How do I stake my Ethereum?

You can stake Ethereum using Coinbase. Coinbase offers our customers the ability to stake their ETH to earn rewards, and there is no minimum ETH required to stake on Coinbase. When you stake your ETH, it converts to ETH2. Currently, US customers who stake at least $100 in ETH are eligible to earn a 10% bonus (up to $30) on top of earning 4.07% APY on all your staked ETH (Terms Apply, first stake only. Void in NY and HI).

Will ETH automatically become ETH 2? Will Ethereum 2.0 be a new coin?

Once The Merge is complete, there will be no differentiation between ETH 1 and ETH 2, which has since been renamed the execution and consensus layer, respectively.

Will The Merge reduce gas fees?

In the short-term, The Merge is not likely to reduce gas fees because the upgrade is about a change in the consensus mechanism (the way Ethereum validates transactions), rather than an increase or expansion of its capacity.

What other upgrades are coming after The Merge is complete?

There are still a series of other updates following The Merge. The rhyming upgrades are called the surge, verge, purge, and splurge. The surge will include the Shanghai upgrade, which will include the ability to withdraw staked ETH, and sharding, which aims to improve scalability by spreading the burden of processing and handling large amounts of data over an entire network. The verge will let users become network validators without needing to store a lot of data, which is a massive step towards more decentralization. The purge will aim to remove old network history, and the splurge refers to the fine tuning of its preceded steps.

How will scalability be addressed in The Merge?

The original plans of addressing scalability, via sharding, prior to The Merge were swapped due to the boom of layer 2 scaling solutions, with sharding now expected to ship sometime in 2023.

Why is Ethereum moving to Proof-of-Stake?

Ethereum is moving from Proof-of-Work (PoW) to Proof-of-Stake (PoS) in an effort to increase the blockchain’s security, make it less energy-intensive, lower barriers to entry by reducing hardware requirements, and lay the groundwork to improve scalability.

What is the difference between Proof-of-Work and Proof-of-Stake?

Proof-of-Work uses computers across a decentralized network to verify transactions whereas Proof-of-Stake relies on validators that contribute their own token, in this case ETH, as collateral in exchange for a chance to update the block chain with the latest verified transaction and earn newly minted tokens.

STAKE

ETH

EARN

REWARDS

Ethereum on social media in the last 24 hours

366,656 unique individuals are talking about Ethereum and it is ranked #7 in most mentions and activity from collected posts. In the last 24 hours, across all social media platforms, Ethereum has an average sentiment score of 3.4 out of 5. Finally, Ethereum is becoming less newsworthy, with 25 news articles published about Ethereum. This is a 23.53% decrease in news volume compared to yesterday.

On Twitter, people are mostly neutral about Ethereum. There were 38.93% of tweets with bullish sentiment compared to 5.5% of tweets with a bearish sentiment about Ethereum. 55.56% of tweets were neutral about Ethereum. These sentiments are based on 201869 tweets.

On Reddit, Ethereum was mentioned in 2428 Reddit posts and there were 3998 comments about Ethereum. On average, there were more upvotes compared to downvotes on Reddit posts and more upvotes compared to downvotes on Reddit comments.

Powered by LunarCrush

366,656

People who posted about ethereum on twitter and reddit

143,902

Mentions of ethereum analyzed across all social collections

1.48%

Percent of social media posts about ethereum compared to the market

Read more about Ethereum & The Merge

The Ethereum Merge has begun

Ethereum's upgrade was activated this week via the Belaltrix upgrade. And we're breaking down all the week's headlines, answering your top your Ethereum Merge questions and made a reading guide for you to learn more about The Merge.

Sep 07, 2022 - 7 min read

Research insights: what to watch at the Merge

We discuss execution risks to watch out for surrounding The Merge and examine the price action of previous BTC halving cycles to gain insights on what may happen.

Sep 02, 2022 - 9 min read

Decentralization, privacy, and a credibly neutral Ethereum

The following post recaps this episode of Coinbase’s Around The Block podcast in which Viktor Bunin hosts Coinbase CEO Brian Armstrong and Ethereum co-founder Vitalik Buterin discuss decentralization, privacy, and a credibly neutral Ethereum.

Aug 30, 2022 - 3 min read

Ethereum's Merge: Investing at an Inflection Point

We look at both the bear and the bull cases for ETH ahead of the Merge and address some of the misconceptions surrounding what this upgrade means to the network and its users.

Aug 18, 2022 - 10 min read

The Ethereum Merge is Coming: Here’s what you need to know

Ethereum is anticipated to move to Proof-of-Stake (PoS) on or around September 15, 2022 making it more secure, less energy-intensive, and better for implementing new scaling solutions.

Aug 16, 2022 - 5 min read

Eth2 Merge Update - Special Edition

We've got a special edition of the eth2 updates. We're going to cover what the merge does and doesn't do, ingredients of what needs to happen leading up to the merge, and how rewards change right after the Merge. Other updates include growing DAG size concerns on mainnet and post-Merge upgrade details.

Aug 12, 2022 - 5 min read

Ethereum's next 5 upgrades

Ethereum’s Vitalik Buterin says after The Merge, Ethereum will see subsequent, rhyming upgrades called the “surge,” “verge,” “purge,” and “splurge.”

Jul 27, 2022 - 6 min read

Ethereum’s "merge" rally explained

After several weeks of painful headlines, crypto markets saw some relief to start the week. The ETH rally began last Friday after Ethereum developers agreed to an updated September timeline for the blockchain’s long-awaited “merge” upgrade.

Jul 20, 2022 - 7 min read

The Merge and the Ethics of Ethereum?

Ethereum’s shift to PoS will lead to a projected 99.95% reduction in energy consumption compared to PoW. This evolution will be a welcome development at a time when energy costs are surging across the world.

Apr 29, 2022 - 5 min read

A brief history of Ethereum

2013

19-year-old computer programmer Vitalik Buterin, releases a whitepaper proposing a highly flexible blockchain that could support almost any kind of transaction.

2014

Vitalik Buterin, Gavin Wood, in addition to other co-founders, crowdfunds the development of the Ethereum protocol with the sale of $18 million in pre-launch tokens.

2015

In July, the first public version of the Ethereum blockchain launched. Smart contract functionality also begins to roll out on the Ethereum blockchain.

2016

Hackers stole around $50 million from the DAO (short for Decentralized Autonomous Organization). In response, the community votes to make a revision to the protocol to restore the lost funds, resulting in a hard fork & creating two blockchain branches: Ethereum and Ethereum Classic.

2017

ERC-20 standard is created, defining a way to create an asset on top of the Ethereum blockchain. CryptoKitties became the first widely popular Ethereum-based app. MakerDAO launches. Maker also introduces the first ETH-based stablecoin, DAI.

2018

DeFi gains momentum with the arrival of lending protocol Compound and decentralized exchange Uniswap. The USDC stablecoin, backed by the CENTRE Consortium, a partnership between Coinbase and Circle, launches and reaches $1 billion in issued coins in the first year.

2020

The Ethereum 2.0 upgrade begins in December. The transition from Ethereum 1.0 to Ethereum 2.0 is expected to take around two years to complete. Proof of Stake is introduced as part of Ethereum 2.0’s first phase, while ETH 1.0 continues to use Proof of Work as its consensus mechanism.

2021

Multiple upgrades are introduced, including The Berlin, London, and Altair. Berlin upgrade optimized gas cost and increased support for transaction types. The London upgrade improved the transaction fee market and reduced gas refunds. The Altair upgrade was a scheduled upgrade for the Beacon chain.