Is BTC poised for a bigger rally?

In the wake of the Fed’s rate cut, bitcoin climbed near highs last seen in August.

There’s never a dull moment on the blockchain. Here’s what you need to know this week:

Where analysts think BTC is headed next. Plus, a closer look at ETH’s recent price rebound, the correlation between crypto and stocks, and more.

What is wrapped bitcoin? How the new cbBTC token helps bridge the gap between BTC, ETH, and Base.

This week in numbers. The percentage of BTC that’s in the green, Polymarket’s fundraising target, and more stats to know.

MARKET BYTES

BTC rallied after the Fed cut rates, but what will happen next?

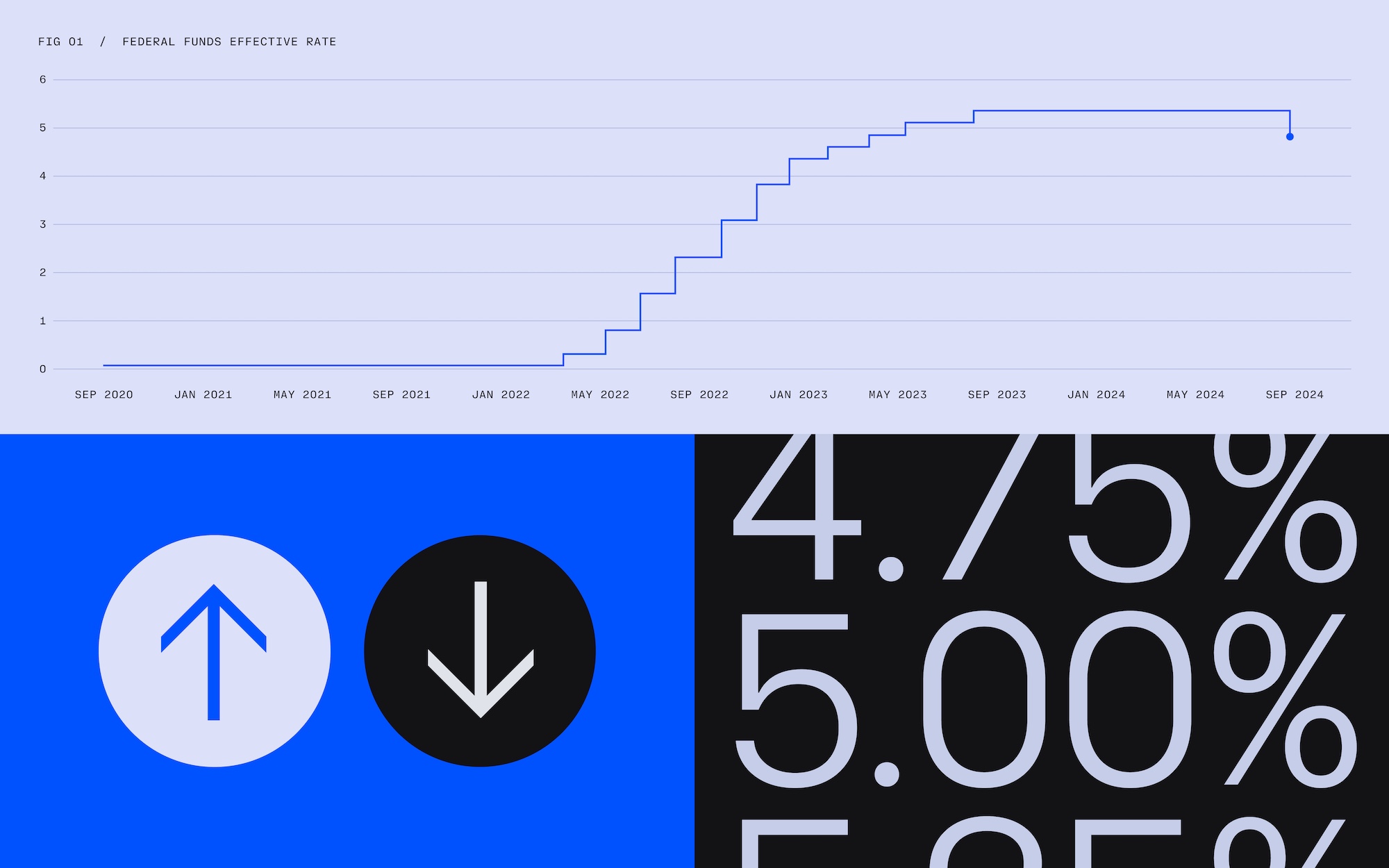

Last week, the U.S. Federal Reserve cut interest rates by half a percentage point — a move that helped boost markets of all kinds, including crypto. In the subsequent week, BTC climbed close to highs last seen in August, reaching above $64,800 on Tuesday.

With one or two additional cuts expected by the end of the year (and news this week that the Chinese government announced “aggressive stimulus measures” to boost its economy), what do analysts say could happen next?

Crypto derivatives markets show many traders are anticipating higher prices, according to the founder of DeFi derivatives protocol Derive.

At the same time, some other analysts expressed caution, suggesting that prices could dip before climbing again.

According to Bitfinex, the key price that market watchers should look for is $65,200, which could precede a potential breakout.

Here are three more market stories to know about this week…

What impact could BTC options trading have on prices?

On Friday, the U.S. Securities and Exchange Commission (SEC) gave the Nasdaq the greenlight to begin listing and trading options for BlackRock’s spot BTC ETF (IBIT). (Options are a form of derivative contract that allow traders the “option” to buy shares of a stock, ETF, or other asset at a given price on a given date.)

Analysts are split on the potential impact on BTC prices. According to Bitwise analyst Jeff Park, the move could allow Wall Street traders to devise new strategies using leverage (or borrowed capital), which has the potential to drive major swings in prices.

Other pundits, including CoinShares’ James Butterfill, suggested the opposite — that options could reduce volatility in the longer term as traders learn to use them to manage risk.

Top of the Rock… A new whitepaper from BlackRock delves into BTC’s increasingly mainstream role on Wall Street and beyond. The report notes that BTC can be seen as a “unique diversifier” for portfolios, that it has frequently outperformed other major asset classes in the last decade (though it has also seen years of significant underperformance), and that for some it represents a "flight to safety" in uncertain geopolitical environments.

ETH rebounds following Fed rate cut

In last week’s edition of Bytes, we noted that ETH has been struggling compared to BTC and other major tokens for months. But in the days since the Fed’s rate cut last week, that dynamic has completely flipped.

ETH gained more than 18% in the week ending Monday, compared to around 7.5% for BTC. The Ethereum blockchain also saw major gains in trade volume, the number of wallets using dapps, and the total value locked on the network.

ETF blues… Despite the rally, spot ETH ETFs saw their worst day of outflows since July on Monday. It’s important to note, however, that virtually all of the outflows came from GrayScale’s massive ETHE product, which has higher fees than the competition. Bitwise’s ETHW saw inflows of around $1.3 million.

Stocks and crypto are more correlated than (pretty much) ever

In the wake of last week’s rate cut from the Fed, crypto and stock markets shared a virtually identical reaction. As Bloomberg put it, the “40-day correlation coefficient for a gauge of the largest 100 digital assets and the S&P 500 Index is at … a level exceeded only in the second quarter of 2022.”

To many analysts, this indicates that both markets are currently driven primarily by macroeconomic forces — meaning that all eyes are on the U.S. central bank for hints about its next move.

Fed says… The next major clue could come later this week, when the Fed is expected to comment on a key consumer-spending metric. Longer term, most analysts expect at least one more rate cut by the end of the year.

IT’S A WRAP

Everything you need to know about wrapped tokens and cbBTC

“Wrapped tokens” offer a solution for users wanting to make DeFi transactions and are designed to bridge the gap between blockchains.

Bitcoin has a lot of advantages: It’s fully decentralized, secure, and immutable. But it also has some limitations, which is why there is wrapped bitcoin.

This month, Coinbase rolled out cbBTC (Coinbase Wrapped BTC). In just three weeks, cbBTC — which is currently supported on Base and Ethereum — has become the third-most popular wrapped bitcoin token on the market, with plans to continue expanding to more blockchains.

But what exactly are wrapped tokens, and why do they matter? Here’s what you need to know…

What is a wrapped token?

Wrapped tokens are a type of cryptocurrency that mirror the value of another cryptocurrency from a different blockchain and address the challenge of interoperability between blockchains. A wrapped token has exactly the same value as the original cryptocurrency, but is compatible with a different blockchain.

Bitcoin and Ethereum, for instance, operate on different protocols and can’t directly interact with each other. Wrapped tokens bridge this gap, allowing assets from one blockchain to be used on another. Wrapped versions of bitcoin can be used to trade on DeFi platforms or as collateral for loans, for example.

Wrapped Bitcoin (wBTC) is the most popular wrapped token, with a market cap of nearly $10 billion, and has become a popular option for bitcoin users to move some of their liquidity to Ethereum without needing to sell their bitcoin holdings.

What is cbBTC?

cbBTC is a wrapped version of bitcoin that can currently be used on the Base and Ethereum blockchains (with support for Solana coming soon.) Like other wrapped tokens, it exists to help create interoperability between blockchains.

cbBTC users can opt to lock some of their bitcoin with Coinbase, which acts as a custodian for the tokens, and receive cbBTC on the compatible blockchain of their choice. (Coinbase has also announced plans to provide proof of reserves for cbBTC in the near future.)

For Coinbase users the minting process is simple. All you need to do is send the bitcoin you have in your Coinbase account to an external address on either Base or Ethereum, and it will automatically be converted 1:1 into cbBTC.

Since launch earlier this month, users have already minted nearly $200 million worth of cbBTC, with around $100 million minted on the first day alone, according to Dune Analytics.

The bottom line…

The launch of cbBTC and its rapid adoption highlights crypto users’ need for trusted and convenient ways to utilize their bitcoin liquidity on other blockchains.

“By bringing assets across more chains, wrapped assets like cbBTC help build a more efficient, interconnected and expansive financial ecosystem,” Coinbase said in a blog post.

NUMBERS TO KNOW

$1.25 billion

Estimated value of assets — including solar farms, private credit, Medicaid-backed invoices, and mineral rights — that the Plume Network says it will have tokenized by the end of 2024. Plume is an Ethereum layer 2 blockchain designed for the tokenization of real-world assets.

$100 million

The total raised this week by the Celestia Foundation, the team behind the Celestia blockchain. Celestia is part of a growing crop of “modular blockchains” which aim to solve scalability issues by enabling speedier transactions.

$50 million

The amount of funding that crypto-based predictions marketplace Polymarket is reportedly looking to raise, according to an article in The Information. The Polygon-based decentralized market, which lets users wager on real-world events, hit an all-time high trading volume in August, driven by interest in the U.S. presidential election.

$16 million

Value of more than 250 long-dormant BTC mined in Bitcoin’s early “Satoshi era” that moved to new wallets last week. “These bitcoin were received as a block reward in 2009, just months after the network started,” reports CoinDesk. “These wallets have shown no activity since then except for the movement on Friday.”

86%

The approximate share of bitcoin’s supply that is currently in profit — or worth more than when it was purchased — according to data from CryptoQuant. The share of bitcoin’s supply in profit just passed its 365-day moving average, which in the past has been a signal for potential further price gains.

TOKEN TRIVIA

Which of the following is a mobile security best practice?

A

Being mindful of public Wi-Fi

B

Adding authentication

C

Using security keys

D

All of the above

Find the answer below.

Trivia Answer

D

All of the above