Where are crypto markets headed in Q4?

Where are crypto markets headed in Q4? David Duong, Coinbase’s head of institutional research, shares what he’s keeping an eye on in the coming months.

There’s never a dull moment on the blockchain. Here’s what you need to know this week:

Bitcoin revisited $64K before dropping slightly. Plus, Visa and PayPal are expanding stablecoin offerings, hedge funds are increasingly bullish on crypto, and the latest market headlines.

How will Q4 play out for crypto markets? We asked Coinbase’s Head of Institutional Research, David Duong, for his view on what lies ahead.

This week in numbers. Polymarket’s record amount of traders, Solana’s growing number of tokens, and more stats to know.

MARKET BYTES

Are we on track for an “Uptober” to remember?

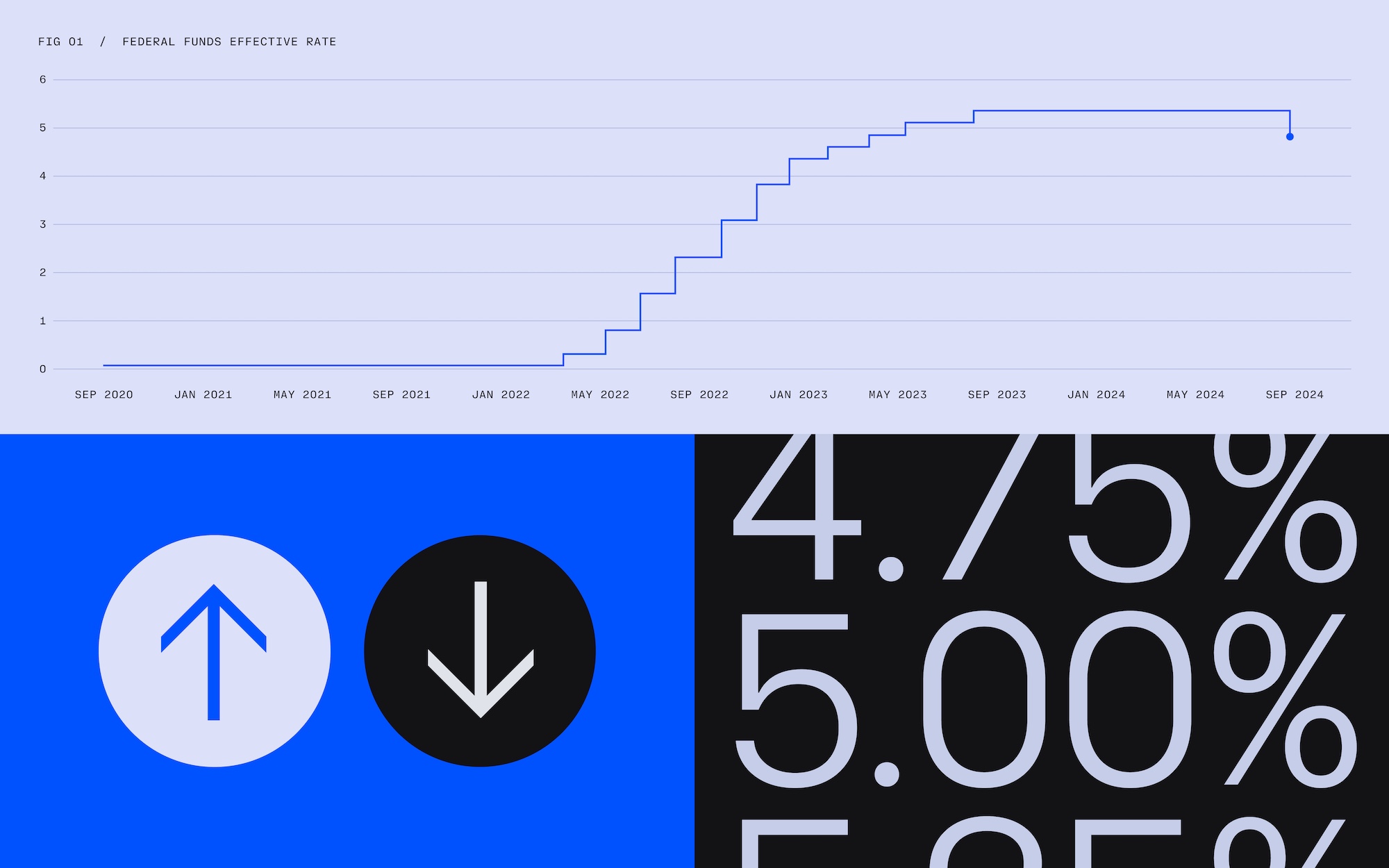

In the three weeks since the Federal Reserve cut interest rates, investors have been anticipating the next move for bitcoin – especially as the calendar rolls deeper into the month that crypto enthusiasts have nicknamed “Uptober” due to its historically bullish price action.

So how’s it going? A bit mixed! Prices have been swinging up and down from week to week recently as new catalysts emerge and fade (more on what to expect from the next few months in the Q&A below).

On Monday, BTC topped $64,000 — up around 6% since the rate cut — after new data emerged on Friday showing the U.S. labor market added 100,000 more jobs than expected. By Wednesday morning BTC was straddling $62,000. Meanwhile, market watchers are paying close attention to clues that could indicate when the Fed will cut rates next, and more key U.S. economic and inflation data is expected on Thursday in the form of the consumer price index.

Of course, interest rates aren’t the only story. Markets are also reacting to movements in the approaching U.S. presidential election and an increasingly tense geopolitical situation.

Here are three more stories you should know about.

Inflows return for Bitcoin ETFs

The volatility in crypto markets generally has been mirrored by spot BTC exchange-traded funds (ETFs), which saw around $300 million in outflows last week before reversing course on Monday with more than $250 million of new capital. Fidelity’s FBTC and BlackRock’s IBIT funds each notched around $100 million in inflows.

What about ETH? Even though ETH prices were also up on Monday, spot ETH ETFs numbers didn’t reflect the gains, as they netted roughly zero inflows or outflows. As BlackRock’s head of digital assets noted last week, institutional investors may still not be as familiar with ETH as with BTC: “With ETH, I think the investment story and narrative is a bit less easy for a lot of investors to digest, so that’s a big part of why we’re so committed to the education journey that we’re on with a lot of our clients.”

Visa and Paypal bet on stablecoins

One of the big narratives of 2024 has been the rise of tokenized real-world assets. Stablecoins are by far the biggest of that asset class — which is why it’s not surprising that traditional payments giants are investing in the technology, especially as they allow for speedy, inexpensive, and 24/7 global transactions. (Stablecoins are cryptocurrencies whose value is pegged to a reserve currency, like the U.S. dollar.)

Last week, Visa announced a new product called Visa Tokenized Asset Platform (VTAP), which will allow financial institutions to issue their own fiat-backed stablecoins (or other tokenized assets) on the Ethereum blockchain. The program is currently in testing with a Spanish bank, with the plan of fully launching in 2025.

Pal around… In other stablecoin news, PayPal, which launched its own PYUSD stablecoin last year, recently used the token in a business transaction for the first time when it paid an invoice to Ernst & Young. “Business-to-business transactions – especially those that cross borders – can be drawn out, expensive and, in some cases, risky, given the requisite reliance on third parties,” a PayPal executive noted to Bloomberg, “The speed and availability of settlement with this use case is far more attractive.”

Hedge funds are increasingly bullish about crypto

The rise of BTC ETFs has been a major sign of Wall Street’s ever growing interest in bitcoin. And among Wall Street firms, hedge funds appear to be the most bullish institutional players in the market, according to a new report from the Crypto Insights Group.

In the firm’s recent survey of dozens of liquid crypto funds, the vast majority of hedge funds are expecting higher crypto prices over the short, medium, and long term.

Around 60% of funds are expecting higher prices or “much higher” prices in the next month, 90% are expecting the same over the next three months, and 95% are expecting higher or “much higher” prices over the next 12 months.

Beating the market… Since 2017, crypto-focused hedge funds have notched an average 80% annualized return, according to data from Preqin, and in that same span the number of crypto-focused funds has risen more than 20-fold, from 55 to more than 1,200.

Q&A

What will Q4 bring for crypto markets? We asked Coinbase’s Head of Institutional Research

“Where might crypto markets head next?” That’s a key question Bytes frequently assesses by gathering insights from expert analysts across the cryptoverse.

One of those trusted voices is Coinbase’s Head of Institutional Research, David Duong, who every week produces in-depth crypto market analysis, research, trend insights, and more.

This week, we talked to David about the themes he’s watching in the final months of 2024 and (you guessed it) where he thinks crypto markets might head next.

Here’s what he had to say.

Bytes: Now that the Fed has started to unwind interest rates, do you anticipate further rate cuts in Q4?

David Duong: Yes, though the Fed’s exact policy path depends on upcoming macroeconomic data — more so labor than inflation.

The Fed acknowledged that September’s 0.50% cut was because they were behind the curve and should have started cutting in July. Since there will be no October FOMC meeting, it made sense for them to go higher than a 0.25% cut this first time.

But one of the most important implications of the Fed’s 0.50% cut is that this provides cover for other monetary authorities to take more stimulative measures. This is precisely what we’re seeing out of the People’s Bank of China, for example, where they are taking an extraordinary joint monetary and fiscal approach to remedy their economic issues.

Looking ahead, I would still expect two more 0.25% rate cuts in November and December, potentially followed by another full percentage point of cuts over the course of 2025.

What other big-picture catalysts are you watching that could impact BTC prices in Q4?

U.S. elections are the biggest catalyst for both traditional and crypto assets in Q4. Anything pertaining to global economic activity is also worth watching right now, from the impact of hurricanes in the southeastern U.S. to geopolitical conflict in the Middle East. Closer to crypto, watching the FTX claims payout process is essential.

Ultimately, I’m still fairly constructive on crypto markets in Q4, reverting from our defensive position in Q3. I don’t think BTC will stay range-bound by the time we’re done with Q4, as the macro environment will favor more risk taking.

In a recent Coinbase Institutional report, you explained ETH’s underperformance over the last several months. What will it take for ETH to regain ground?

I still think we could see a reversal of fortune for ETH, particularly as spot ETH ETF inflows could pick up in Q4, which would trigger short covering by speculative traders and a potential virtuous cycle for the underlying token.

But for ETH to catch up, we think Ethereum needs a new catalyst to help reignite both developer and investor enthusiasm. That could come in the form of more experimentation on the mainnet to compete with alternative L1s, or the onboarding of more real world assets onto the platform.

What most institutional players want to see, however, is the launch of applications with broader public appeal that fully utilize Ethereum’s potential.

What are some deeper crypto themes you are watching?

Tokenization is still a very big theme, and many pundits are describing the stablecoins and payments sector as the “killer app” of the crypto space given its product-market fit.

My impression from recent crypto conferences is that the broader crypto community is focused more on emerging alternative layer-1 networks like Berachain and Monad over existing Ethereum layer-2s, which I thought was more of a narrative early in this cycle.

Meanwhile, Bitcoin L2s — in the form of Babylon (staking) and BitVM based protocols — could be a novel way of putting bitcoin liquidity to work, and the appetite is there.

I also think the restaking movement that started with EigenLayer is worth following to see how this next phase plays out.

NUMBERS TO KNOW

90,000

The number of monthly active traders that Polymarket logged in September, its highest total ever. The crypto-based, real-world event betting marketplace has become the leading venue to wager on the 2024 presidential election, with more than $500 million in bets being placed on the potential outcome.

11,500

The approximate number of financial institutions that are part of SWIFT, the banking infrastructure that helps enable international financial transactions. Starting next year, institutions in North America, Europe, and Asia will begin experimenting with using SWIFT to facilitate cross-border cryptocurrency transactions

84%

The share of new crypto tokens that were launched via Solana in September. Of the approximately 129,000 new tokens launched on decentralized exchanges last month, more than 108,000 were launched on Solana. Base, the blockchain incubated by Coinbase, was second, with around 15,000 tokens launched.

SECURITY PSA

How to spot, and help stop, online scams

Scammers are increasingly targeting younger, online users — last year Gen Z saw the highest median loss to scams for a second year in a row. Some common threats to watch out for are: social media fraud, romance scams, fake websites, and recovery schemes.

We've got some quick tips you can use to make sure you’re informed and protected from would-be scammers and bad actors. Remember: Stay alert and help us keep the crypto community safe by reporting any suspicious activities.

TOKEN TRIVIA

How many U.S. adults owned crypto in 2023?

A

18 million

B

27 million

C

52 million

D

93 million

Find the answer below.

Trivia Answer

C

52 million