What is an order book?

Order books show not only the price buyers and sellers are willing to pay, but also how many discrete units (as in shares or tokens) they seek to buy or sell at each price. Learn m...

Ready to advance? Learn the tools and terminology you need to take control of your trades.

Order books show not only the price buyers and sellers are willing to pay, but also how many discrete units (as in shares or tokens) they seek to buy or sell at each price. Learn m...

What are limit orders, market orders, stop-limit, or bracket orders? Find out in part two of our guide to the advanced trading tools that let you take greater control of your portf...

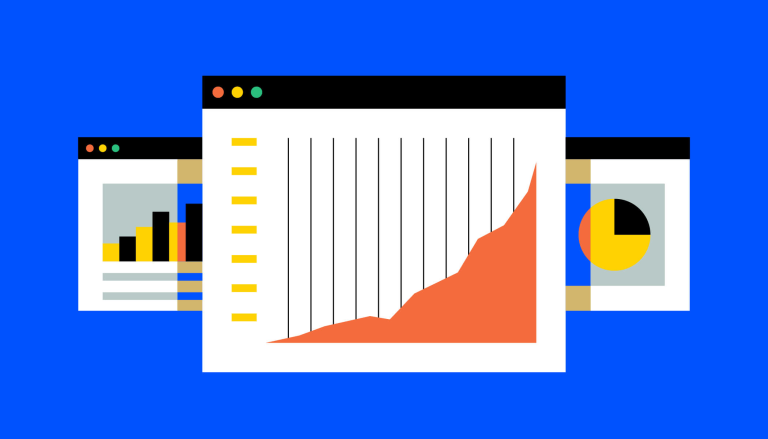

Learn how to read financial charts in part three of our guide to advanced trading — tools and terminology to help you take control of your trades.

Technical analysis looks at patterns in market data to identify trends. Fundamental analysis is a more “big picture” approach.

AMMs are a component of the decentralized finance (DeFi) ecosystem, enabling permissionles...

Sharding is a technique that seeks to enhance the scalability of blockchain networks by di...

A bonding curve is a mathematical concept that defines the relationship between the price...

DeFi aggregators bring together trades across various decentralized finance platforms into...

An OCO order is a pair of conditional orders where the execution of one cancels the other....

Cryptocurrency index funds aim to provide diversified exposure to the digital asset market...

A short squeeze refers to a rapid increase in the price of a stock or other tradable secur...

A black swan event in crypto is an unexpected occurrence that significantly impacts the ma...

DeFi liquidation is a process that occurs when the value of a borrower's collateral in a D...

Open Interest (OI) is a tool that monitors the total number of open positions in a specifi...

Automated trading bots are systems that facilitate users to execute trades on various plat...

NFT staking is a process where NFT owners may receive compensation by locking their digita...

Crypto lending is a process where cryptocurrency is lent to borrowers in return for regula...

Flash loans are a type of uncollateralized loan in the decentralized finance (DeFi) ecosys...

Crypto arbitrage trading is a strategy that capitalizes on price differences of a particul...

Crypto margin trading, also known as leveraged trading, allows users to use borrowed asset...

CBDCs aim to reduce costs in the financial sector while striving to increase transaction s...

Algo trading, short for algorithmic trading, is an automated system that uses computer pro...

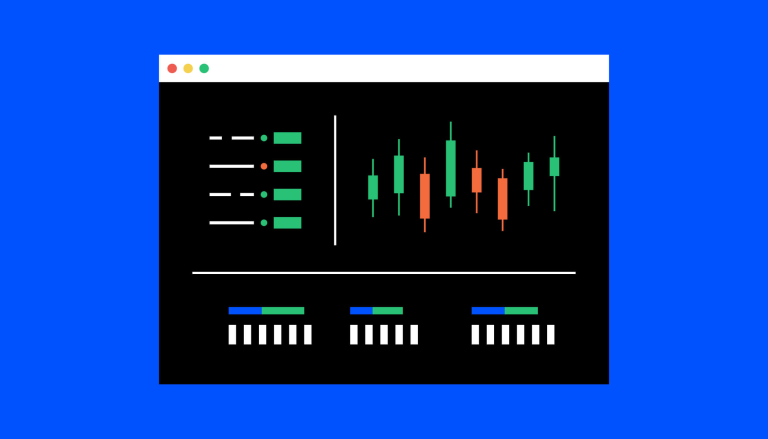

Welcome to this comprehensive guide created for the purpose of assisting Coinbase traders...

As a crypto spot trader, futures markets are a valuable source of information and can be u...

Learn how to manage your orders on Coinbase in the last part of our advanced trading serie...

A risk reversal options strategy in crypto involves acquiring a call option and disposing...

Onchain analysis is the examination of blockchain data to understand transaction patterns,...

Fully Diluted Valuation (FDV) is a metric used to estimate the future potential of a crypt...

Restaking is a method that allows users to stake the same tokens on the main blockchain an...

Crypto borrowing is a process that allows for liquidity without the need to sell crypto as...

Grid trading bots automate the process of buying and selling cryptocurrencies within a pre...

This article delves into the distinctions between liquid staking, traditional staking, and...

Delta hedging is a strategy used in options trading to reduce the risk associated with pri...

Covered calls in crypto are a strategy that involves owning an underlying asset and sellin...

The Bitcoin Rainbow Chart is a technical analysis tool that visualizes the historical pric...

Algorithmic Market Operations (AMOs) utilize mathematical models and algorithms to execute...

Frontrunners and MEV (Miner Extractable Value) are strategies used in crypto trading to op...

Lockdrops and airdrops are methods of distributing tokens in the crypto world. Lockdrops r...

Ranges in crypto trading refer to the fluctuation of a cryptocurrency's price within a spe...