Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

These rules apply to the extent Coinbase Bermuda operates a central limit order book trading platform and settle trades in a number of digital asset trading pairs. Each Customer’s account will list which order books are available to the Customer. In order to maintain integrity on the Exchange, a number of Exchange Rules will be implemented. The primary Exchange Rules are listed below, are subject to change based on Coinbase Bermuda’s determination, and are not limited to the below.

Orders: Market Order, Limit Order, Take Profit Stop Loss, and Stop Limit Order

Order protection price points

Self-trade prevention

Flash crash and circuit breakers

Market manipulation prohibited

1. Trading on Coinbase International

1.1 Coinbase operates a central limit order book trading platform, and settles trades in a number of Digital Asset Trading Pairs. Each Trader’s Account will list which Order Books are available to the Trader.

1.2 Orders

1.21 To place an Order on an Order Book, a Trader must have an Available Balance/Collateral of a relevant Asset in their Account which is sufficient to cover the total value of the Order plus any applicable fees.

1.22 When a Trader places an Order, that quantity of the relevant Asset becomes subject to a Hold.

1.23 A Trader can place an Order as a Market Order, Limit Order, Take Profit Stop Loss, or a Stop Limit Order

1.24 A Trader may cancel an open Limit Order, Take Profit Stop Loss, or a Stop Limit Order. No fees are charged for canceled Orders.

1.3 Limit Orders

1.31 A Limit Order is an Order to buy or sell a specified quantity of an Asset at a specified price.

1.32 A Limit Order will only Fill at the specified price or a better price.

1.33 A Limit Order will be immediately posted to the Order Book (subject to any Time in Force Instructions) and can result in a Maker Order or a Taker Order, or an Order that is partially a Maker Order and partially a Taker Order.

1.34 Limit Orders may be placed with one of the following Time in Force Instructions.

Good til canceled: if posted, the Order will remain on the Order Book for up to 30 days or until canceled by the Trader. This is the default Time in Force Instruction.

Immediate or Cancel: the Order will only be posted to the Order Book to the extent that it would be immediately Filled; any remaining quantity is canceled. This results in a Taker Order.

1.4 Market Orders

1.41 A Market Order is an Order to buy or sell a specified quantity of an Asset at the best available price of existing Orders on the Order Book.

1.42 There is no guarantee that a Market Order will Fill at the price specified. A Market Order may Fill at a number of different prices, based on the quantity of the Market Order and the quantities of the existing Orders on the Order Book at the time.

1.43 Depending on the volume and prices of Orders on the Order Book at the time when a Market Order is posted, the Market Order may Fill at a price less favorable than the most recent trade price, in some cases significantly so. This is commonly referred to as ‘slippage’.

1.44 A valid Market Order will be immediately posted to the Order Book. A Market Order is always a Taker Order.

1.5 Stop Orders

1.51 A Stop Order is an instruction to post an Order to buy or sell a specified quantity of an Asset but only if and when the mark price on the Order Book equals or surpasses the Stop Price.

1.52 Once a Stop Order has been placed, it is considered ‘active’ until it executes by posting the relevant Order when the Stop Price is triggered.

1.53 A Stop Order is not posted to the Order Book and is not visible to other Traders, but any resulting Order is posted and visible.

1.54 A Stop Order must be placed as a Stop Limit Order which posts a Limit Order when the Stop Price is triggered.

1.55 A Stop Limit Order is not guaranteed to Fill. The Web Interface will display a warning each time a Trader attempts to place a Stop Order.

1.56 Take Profit Stop Loss Order is a Limit Order to buy or sell a specified quantity of an Asset at a specified price, with stop limit order parameters embedded in the order. Take Profit Stop Loss Orders functions the same way as a Limit Order, but if the stop price is triggered before an execution on the original Limit Order, the original Limit Order will be repriced to the stop limit price. If the original Limit Order is partially filled, the stop price and stop limit price will not be triggered, and the open portion of the Limit Order will remain at the original Limit Order price.

1.57 Stop Orders may be placed with one of the following Time in Force Instructions.

Good til canceled: if posted, the Order will remain on the Order Book for up to 30 days or until canceled by the Trader. This is the default Time in Force Instruction.

Good til time: if posted, the Order will remain on the order book until a certain time is reached or the Order is canceled by the trader.

1.6 Order Protections

1.61 Limit Orders and Stop Orders are subject to a price protection point (PPP). Limit and Stop Orders will fill at prices up to the PPP from the mid-point price between the best bid and best offer on the Order Book at the time the Order was placed. If a Limit or Stop Order would fill against Orders beyond the PPP, the Order will partially fill up to the PPP level and the matching engine will cancel all remaining portions of the Order.

Order Size Limits

1.62 Order Minimums: All Limit Orders and Stop Orders placed on Coinbase Markets may be subject to the minimum order size requirements listed at (public ink TBD).

1.63 Updating Order Parameters: Coinbase Markets will periodically update our market parameters to reflect the current state of our marketplace and the notional value of the assets.

1.7 Matching Engine and Order Priority

1.71 Coinbase Markets matches Taker Orders with Open Maker Orders on each Order Book based on Price-Time Priority.

1.72 Price-Time Priority means that each time a Taker Order is posted: The Taker Order is matched with the earliest in time Maker Order at the best price on the Order Book; and To the extent that the Taker Order is not completely Filled by that Maker Order, it is matched with any subsequent Maker Orders at that price, in the sequence those Maker Orders were posted; and To the extent that the Taker Order is not completely Filled by one or more Maker Orders described above, it is matched with one or more Maker Orders at the next best price, in the sequence those Maker Orders were posted, and this process is repeated until the Taker Order is completely Filled.

1.73 All Traders on accessing Coinbase Markets are subject to the same Price-Time Priority.

1.74 Subject to Time in Force Instructions, an Order may be matched with a number of corresponding Orders at the same price.

1.75 Taker Orders are matched with the best available existing Maker Orders. This means that a Limit Order placed outside the market (i.e. a sell Order below the highest existing buy Order, or a buy Order above the lowest existing Sell Order) will be Filled by the best available existing Order rather than an existing Order with the same price as the Limit Order.

1.8 Fills and Settlement

1.81 When a Maker Order is matched with a Taker Order, those Orders are Filled. An Order may be matched with and Filled by one or more Orders at the same price.

1.82 Coinbase Markets settles all Filled Orders immediately, by debiting and crediting the relevant balances of Assets in both Traders’ Accounts.

1.83 Subject to daily withdrawal limits a Trader may immediately withdraw all Assets in their Account.

1.9 Trading Fees

1.91 The estimated fees charged by Coinbase Bermuda to customers are summarized below. As per the purposed User Agreement provided in support of the Application, applicable fees are published on website [https://help.coinbase.com/en/international-exchange/trading-deposits-withdrawals/international-exchange-fees] at any given time:

1.92 Fees for Perpetual Futures trading will range from 0 to 60 bps and will vary according to whether the user is a maker or taker.

2. Market Integrity

All Trades are Final

2.1 Coinbase Bermuda intends to provide Customers with access to digital asset derivative, spot margin and spot market products. The exchange applies various risk management practices to prudently manage the risks to which it is exposed, including market, credit, and liquidity risks. Some of the risk management practices include:

Real-time risk monitoring

Counterparty credit and liquidity risk management;

Daily exchange of funds for mark-to-market movements;

Initial margin collection; and

Financial safeguards waterfall, through automated trading functionality, that securely deleverages overall positions held across several exchange accounts.

2.12 All Fills are final and will not be reversed unless:

Coinbase is compelled to do so by any applicable law or regulation; or

Due to a serious technical error, Orders or Fills do not occur as specified in these Rules - in which case Coinbase will make all reasonable efforts to restore all Traders to the position they would have been in had the error not occurred.

2.13 Coinbase may cancel Open Orders in the following circumstances:

Orders placed by Traders who, in our sole discretion, have engaged in abusive use of the platform, for example, Market Manipulation, or using the API in a manner which unreasonably burdens the platform.

Orders which under the circumstances involve an obvious error with respect to price, quantity, or other parameters - a ‘clearly erroneous transaction’.

If required by any applicable law or regulation, including specifically where Coinbase is required to suspend or terminate a Coinbase Trader’s Account.

If required for technical reasons.

2.2 Access to Coinbase Bermuda

2.21 All Traders have equal access to the Coinbase APIs and Web Interfaces. Coinbase does not provide prioritized access to any Trader.

2.22 Coinbase Market Operations has the authority to take any action deemed appropriate to preserve market integrity. Such actions include, but are not limited to, the halting of trading, modifying risk-mitigating parameters, restricting Trader access to Coinbase Bermuda, restricting order types to limit only, canceling orders resting in the order book, or any other actions deemed to be in the best interest of the Exchange.

2.3 Interruptions

2.31 If technical reasons prevent or degrade Traders’ ability to place or cancel Orders, or prevent or degrade access to Coinbase APIs or the Web Interfaces or affect the operation of Coinbase Markets Order Books or matching engines, then Coinbase may, in its discretion, take one or more of the following actions in respect of one or more Order Books;

Temporarily disable depositing or withdrawing Assets.

Cancel Open Orders.

Disable sign-in.

Disable the Coinbase Bermuda APIs.

Disable access to the Web Interface.

2.32 If Coinbase Bermuda is in Trading Paused Mode, it will be restored to fully operational only after access through the Web Interface becomes available for at least 5 minutes and Coinbase deems it is safe to restore Coinbase Bermuda to fully operational.

2.33 Coinbase will notify Traders of the move to or from Trading Paused Mode via Coinbase Twitter handles and Status Page.

2.4 Self-trade Prevention

2.41 Traders are not able to place an Order which would result in self-execution—i.e., where the same Trader would act as both the maker and taker for the trade.

2.42 If two Orders of the same quantity would result in self-execution, both Orders are canceled.

2.43 If two Orders of different quantities would result in self-execution, the smaller Order is canceled and the larger order is decremented by an amount equivalent to the smaller quantity. The remainder of the larger order remains Open.

2.5 Flash Crashes and Circuit Breakers

2.51 Coinbase Markets does not use circuit breakers or automated trading halts based on predetermined price bands. As provided in Section 2.22 and 2.31, Coinbase Market Operations may, in its discretion, halt trading.

2.6 Market Manipulation Prohibited

2.61 Traders are prohibited from engaging in Market Manipulation.

2.62 Market Manipulation of any kind is strictly prohibited. Market Manipulation is defined as actions taken by any market participant or a person acting in concert with a participant which are intended to:

Deceive or mislead other Traders;

Artificially control or manipulate the price or trading volume of an Asset; or

Aid, abet, enable, finance, support, or endorse either of the above. This may include actions on Coinbase and/or outside of Coinbase.

2.63 Market Manipulation specifically includes, without limitation: front-running, wash trading, spoofing, layering, churning, and quote stuffing.

3. Access to Information

3.1 All Traders have full and equal real-time access to Market Data. Market Data is made available through the Web Interface or the Coinbase API.

3.12 Market Data comprises the following:

All Limit Orders placed on the Order Book (price, quantity, and time).

All canceled Orders on the Order Book (price, quantity, and time).

All Fills or Executions (price, quantity, and time).

3.13 Market Data does not include the following:

Resting Stop Orders (Stop Orders that have been placed but not triggered)

Any information about which Trader placed or canceled an order.

3.2 Coinbase Employee Access

3.21 Coinbase policies prohibit all Coinbase employees from using inside, corporate or proprietary information to trade Digital Assets.

3.22 Coinbase employees are required to trade Coinbase supported assets on Coinbase products subject to Coinbase’s employee trading policy and trade surveillance program.

4. Scheduled Downtime

4.1 From time to time, Coinbase may suspend trading temporarily for maintenance or upgrades. Absent extenuating circumstances, Coinbase Bermuda will follow this process for closing and re-opening trading;

Step 1: Announce Scheduled Downtime

Announce the above via dedicated ecomms platform

Step 2: Scheduled Downtime Begins

Step 3: Immediately after Scheduled Downtime is Completed

All books enter ‘Trading Paused' mode

Announce the above via dedicated ecomms platform

To ensure a fair and orderly marketplace, Coinbase Market Operations may in its discretion cancel all resting limit orders in an order book before moving the market to Trading Paused mode or to limit-only mode

Step 4: At least 1 minutes after Step 3; or longer if necessary

All books enter Limit-Only mode

Announce the above via dedicated ecomms platform

Step 5: At least 10 minutes after Step 4; or longer if necessary

All books enter Full-Trading mode

When the exchange moves from Trading Paused to Full Trading marketable best bids and offers that remain on the book will be executed.

Announce the above via https://status.international.coinbase.com/history

5. Definitions

In these Coinbase Markets Trading Rules, the following words and phrases have the corresponding meanings.

Account means a Trader’s Coinbase Account.

Asset means a Digital Asset or Fiat Currency.

Available Balance means a Trader’s Total Asset Value less any amounts held for Open Orders and fees.

Base Asset means the Asset being traded on the Order Book; the first Asset in the Trading Pair. For example, on the BTC-USDC Order Book, BTC is the Base Asset and USDC is the Quote Asset.

Digital Asset means a blockchain-based digital currency, app coin or protocol token which is offered for trading on Coinbase.

Fiat Currency means a government-issued currency.

Fill means a match of two Orders. Also referred to as an execution.

Full Trading Mode means normal operation of Coinbase International Exchange. Traders can place Limit orders and can cancel Orders.

Hold means the setting aside of Assets allocated to an Order.

Limit Order means an Order to buy or sell a specified quantity of an Asset at a specified price.

Limit-only Mode means that Traders can only place and cancel Limit Orders but any Market Order will be rejected. During this mode, Limit Orders can be filled.

Market Order means an Order to buy or sell a specified quantity of an Asset at the best available price of existing Orders on the Order Book.

Order means an instruction to buy or sell a specified quantity of the Base Asset at a specified price in the Quote Asset.

Order Book means each order book on which Orders are placed for trading in a Trading Pair.

Open Order means a Maker Order which has been posted but not Filled, canceled or expired, or a Stop Order which is currently active.

Trading Paused means that the exchange is moved to a state where no trades can execute and only limit orders are accepted. In Trading Paused Mode no orders can execute.

Price-Time Priority means that earlier in time Orders have priority over later Orders. See sections 1.23 and 1.24.

Quote Asset means the Asset in which trading is denominated on the Order Book; the second Asset in the Trading Pair. For example, on the BTC-USDC Order Book, BTC is the Base Asset and USDC is the Quote Asset.

Scheduled Downtime means a planned temporary outage for maintenance or upgrades. See section 4.

Stop Order means an instruction to post an Order to buy or sell a specified quantity of an Asset but only if and when the last trade price on the Order Book equals or surpasses the Stop Price.

Stop Price means the price specified in a Stop Order.

Take Profit Stop Loss Order is a Limit Order to buy or sell a specified quantity of an Asset at a specified price, with stop limit order parameters embedded in the order.

Total Asset Value means the gross value of all of a Trader’s Assets for the relevant Order Book, expressed in the Quote Asset based on the last trade price. This includes all Assets allocated to Open Orders.

Trader means each customer trading on Coinbase International Exchange.

Trading Halt means that Traders cannot place or cancel any Orders.

Trading Pair means each pair of a Base Asset and a Quote Asset offered on Coinbase International Exchange.

6. Derivatives Rules

Coinbase Markets is Coinbase's set of limit order books that are accessed by clients through the Coinbase International trading platforms. The following set of Trading Rules governs orders placed via these trading platforms. Please see below chart for breakdown of key differences between Coinbase Spot Exchange vs Coinbase Bermuda.

Crypto Spot vs. Futures:

Topic | Spot | Futures (Bermuda) |

|---|---|---|

Ownership of Crypto | Yes | No |

Profit Opportunities | Profits in bull markets | Potential profit in both Bear and Bull markets |

Capital Requirement | Pay full value of token | Pay percentage of token value |

Liquidity | Strong Liquidity | Stronger Liquidity |

Price | Spot Price | Spot Price +/- premium |

Futures

What are Futures? Futures (or Futures contracts) are a derivative financial contract that enable parties to buy or sell a specific asset at a predetermined price at a future date. These contracts function as a two-party commitment, where the buyer is obligated to purchase or the seller is obligated to sell the underlying asset at the set price, regardless of the current market price at the expiration date. Futures are used for hedging and or trade speculations.

What are Perpetual Futures? Perpetual futures are similar to a normal futures contract, however unlike the traditional form of futures, it doesn’t have an expiry date. This feature allows the trader to hold a position in perpetuity. An additional feature is that the trading of perpetual contracts are based on an underlying index, consisting of major spot markets for the particular asset, that helps keep the price of the perpetual futures in line with the spot market.

What are Pre-Launch Futures? Pre-launch markets allow users to trade perpetual futures contracts on tokens that have not launched yet. When the underlying token is launched on applicable spot exchanges, the instrument converts to a standard perpetual futures contract.

7. Initial Margin

Coinbase International Exchange will set Initial Margin Requirements for all traded contracts on the exchange. Initial Margin Requirements represent the amount required to place an order for a given contract and are defined by the Risk team, based on real-time market conditions, including liquidity and volatility, to ensure sound risk management of the overall exchange.

Initial Margin (“IM”) is determined by using three metrics: Close Out Horizon (“CoH”), Replacement Price (“Rp”) and Base Initial Margin (“BIM”).

Base Initial Margin (“BIM”) is the minimum borrow capacity applied to collateral, which is based upon the overall portfolio leverage on the exchange platform. The base level of initial margin required is defined as 20%, which allows a maximum leverage of 5x. BIM levels are adjusted according to the average leverage utilized by the entire ecosystem through a margin ladder concept. This means that if the average leverage is 2x, the BIM would be 50% and if the average leverage increases to 5x, BIM increases to 20%.

Close Out Horizon (“CoH”) determines how long it will take to liquidate total open positions, assuming the liquidation only accesses a small % of average daily trading volume. CoH determines how long it will take to liquidate the positions, assuming 1% of average daily trading volume (30 days) and total open position notional. Close Out Horizon (CoH) is calculated by the following equation:

CoH = ( open position size ) / 1% of Average Daily Quantity USD (30 days)

Replacement Price (“Rp”) is a static value for controlling the risk of loss in liquidations scenarios. The Rp is calibrated on a daily basis to a 99.7% confidence interval and protects the exchange against full liquidation losses, which is updated by the Risk Quant team on a monthly basis. If the particular market faces high volatility, the Rp can be revised more frequently.

Calculation of the IM is the following:

IM (%) = MAX(BIM , Rp * sqrt (CoH))

The initial margin scales accordingly as open quantity (including executed and open orders) increases relative to the volume of the perpetual future, measured by trading activity on the Bermuda Exchange order book. By using the MAX between the BIM and a margin rate determined by CoH and Rp, our method accounts for varying collateral risk and adjusts for longer close out periods and larger order sizes, while evaluating against average daily trading volume and market liquidity.

Any changes to the configuration of margin requirements or the inputs to margin requirements require Risk review and sign off.

Portfolio Initial Margin (“PIM”) is a weighted average of Initial Margin values across the portfolio, utilizing the cost basis to determine the notional value of the futures positions. A portfolio’s margin equity (or current margin) needs to be greater than PIM in order to increase a position size.

PIM = Σ (IM(i) * open position notional value(i)) / Σ (open position notional value(i))

Example of Initial Margin

A sophisticated user of Coinbase International Exchange, deposits $5mm USDC to trade BTC perpetual futures.

They want to use the entire $5mm as collateral at the highest leverage permissible.

They see the Base Initial Margin is 20% (5x leverage) so attempts to open a $25mm notional position.

The system calculates the actual initial margin required, as the base initial margin is only applicable if the size is liquid relative to 30 days ADTV, and determines the margin requirement for $25mm notional is actually 30% initial margin.

User is able to see the updated Initial Margin, which the user does not have sufficient funds to execute, however decides to enter the order.

User receives a pop up notification saying that the margin requirement is $7.5mm USDC (30% of $25mm) and they do not have sufficient funds to execute – the notification also includes a link to the margin requirements methodology in the UI, showing the user the margin requirements is transparent and they can use our calculator to determine margin.

The materials available cover initial, maintenance, and close out margin calculations and descriptions.

8. Maintenance Margin

Maintenance margin (“MM”) represents the minimum amount of margin required prior to an orderly liquidation. If Current Margin (or account equity) is below the maintenance margin requirement, the liquidation engine will take over the account and perform an orderly liquidation.

Maintenance Margin is set to ⅔ of Initial Margin:

MM (%) = MM_to_IM_Ratio * IM

MM_to_IM_Ratio = 2/3

Example: If IM is 50%, MM is 33%

The MM for any given asset is not used in isolation, rather it is used to compute the portfolio wide maintenance margin. A portfolio will be liquidated when the CM falls below the aggregate value.

Portfolio Maintenance Margin (“PMM”) determines the weighted average maintenance margin for a given portfolio. This is also referred to as ⅔ of Portfolio Initial Margin. If the portfolio’s Current Margin falls under the PMM, the portfolio will start being liquidated.

PMM (%) = PMM_to_PIM_Ratio * PIM

PMM_to_PIM_Ratio = 2/3

9. Close out Margin

Close out margin (“CoM”) represents the margin threshold where actions take place through Liquidity Support Program and the Insurance Funds, and is a metric expressed as a $ and %.

CoM (%) =MAX [CoM to IM Ratio * IM, MM - CoM Spread]

CoM_to_IM Ratio = 1/3

CoM_Spread = 12%

10. CLOB Mark Price

A smoother and more robust representation of the market price, which has the risk of being manipulated.

CLOB Mark Price = Median (Best Bid Price, Best Ask Price, Last Traded Price)

There is also a concept of Fair Value, which is a price that confirms that our CLOB (central limit order book) is in line with the global index. This concept allows us to avoid unnecessary liquidations, caused by our markets being illiquid, high price swings on Bermuda Exchange compared to the global index price of that particular asset.

If the calculated median (CLOB Mark Price) is greater than the current Fair Value LimitUp, then the CLOB Mark Price equals the LimitUp.

If the calculated median (CLOB Mark Price) is lower than the current Fair Value LimitDown, then the CLOB Mark Price equals the LimitDown.

This can be described by the formula below:

min(max(markPrice, limitDown), limitUp)

11. Fair Value

Fair Value is a calculated price used to avoid unnecessary liquidations, from markets being illiquid, and/or high price swings on the International Exchange compared to the global index price of that particular asset.

Fair Value = Spot Index Price + 1-minute TWAP (CLOB Mark Price - Spot Index Price)

LimitDown = (1 - FV Percentage Execution Threshold) * FV LimitUp = (1 + FV Percentage Execution Threshold) * FV

To ensure that we prevent unnecessary liquidations and unfair executions, the Fair Value anchors the CLOB Mark Price and impacts execution of orders and liquidations. When the CLOB Mark Price goes out of the range of either the Fair Order Execution Threshold or Fair Liquidation Execution Threshold, the order or liquidation order will not be executed, and will only be executed once the CLOB Mark Price is within that range.

Normal orders: The limit (Fair Value ± Fair Order Execution Threshold) will ensure orders are not executed if the price is outside of that range

Fair Order Execution Threshold = 5%

Order executes, if:

Limit down ≤ CLOB Mark Price ≤ Limit Up

Order is rejected, if:

Sell order submission Order Submit Price < Limit Down

Buy order submission Limit Up < Order Submit Price (LONG)

12. Funding Fee

Funding introduces periodic payments where the trader will either pay or receive Funding fees. The Funding fee is based on the difference between the perpetual futures and spot price, and the size of the long or short position. Funding fees are only applicable for users who have an open position when the Funding interval ends, and the timing of when the position was established is not considered as a factor. If the user closes their position prior to the funding interval ends, then the user will not be paying or receiving Funding fees. Also, the funding fee is paid/charged according to the funding rate and the users live positions at the time it ended.

Therefore, when a Funding interval ends, all open perpetual futures positions will pay or receive Funding fees. And Funding fees are calculated using the Funding Rate and Position Value, and the equations are as follows:

Funding Fee = Position Value * Funding Rate

Where Position Value is a product of Quantity of the asset (i.e. BTC, ETH) and the Mark Price of the futures market.

Position Value = Quantity * Mark Price

Funding fee payments will show in the user’s deposits/withdrawal history.

Funding Rate

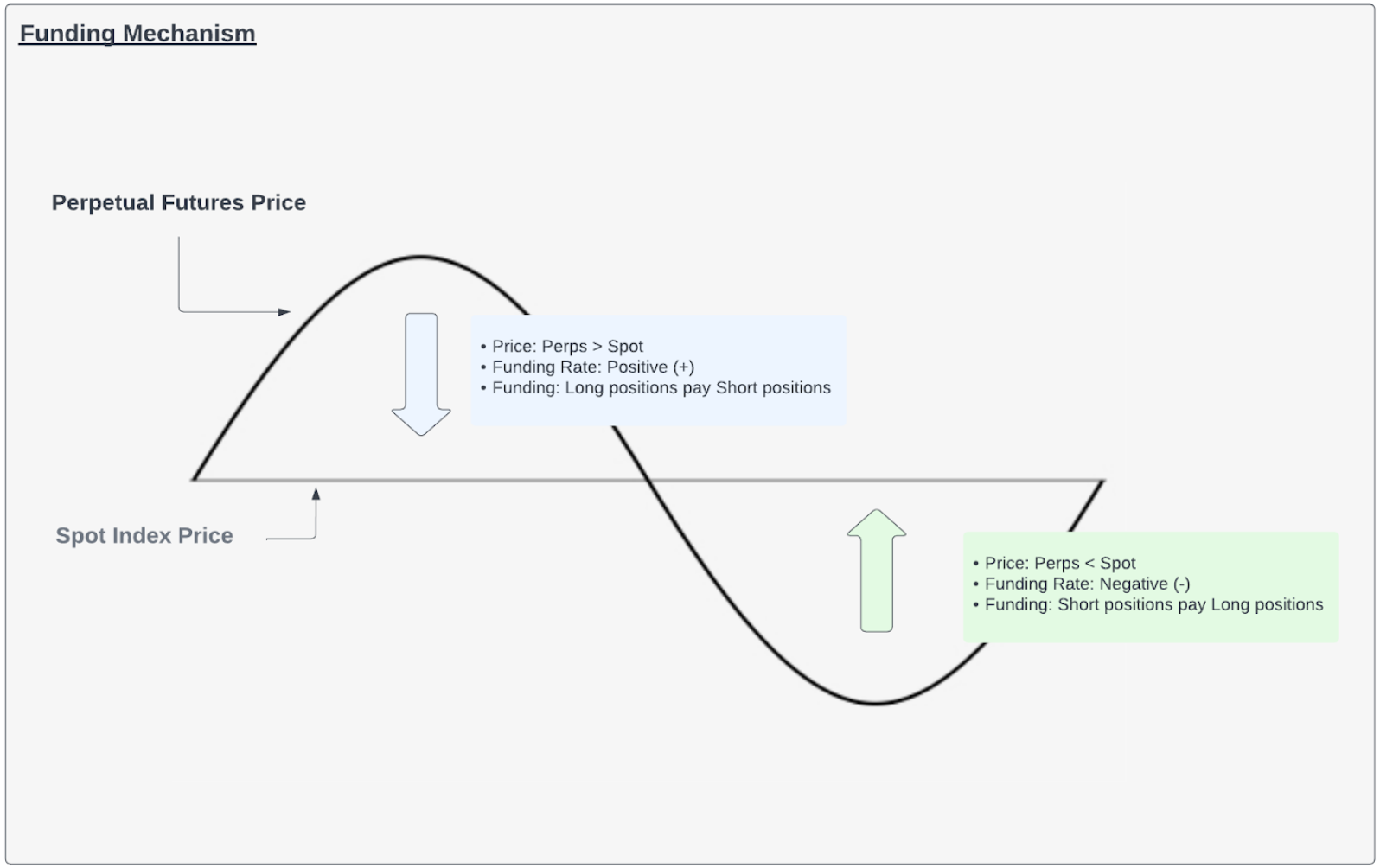

Funding rate represents the difference between the mark price of the perpetual futures market and the Index price, which is equivalent to the Spot market. When the absolute value of the funding rate is larger, the difference between the two prices are wider.

When the Funding Rate is positive, users who have long positions pay users who have short positions. When the Funding Rate is negative, users who have short positions pay users who have long positions.

Settlements of Funding happens every hour, where the settlement price is calculated using a Time Weighted Average Price (TWAP) of the Index Price within an interval of 1 second.

Mark Price

Mark Price = Median (Best Bid Price, Best Ask Price, Last Traded Price)

The Funding Rate is calculated by the following equation:

Funding Rate = (TWAP (Premium, 1 hour, 1 second) *ɑ) + (Previous Funding Rate) * (1-ɑ)

Precision for Funding Rates will be capped at 6 decimal places.

Where the Premium is calculated using the following equation:

Premium = (Mark price - Index Price ) / Index Price / 24

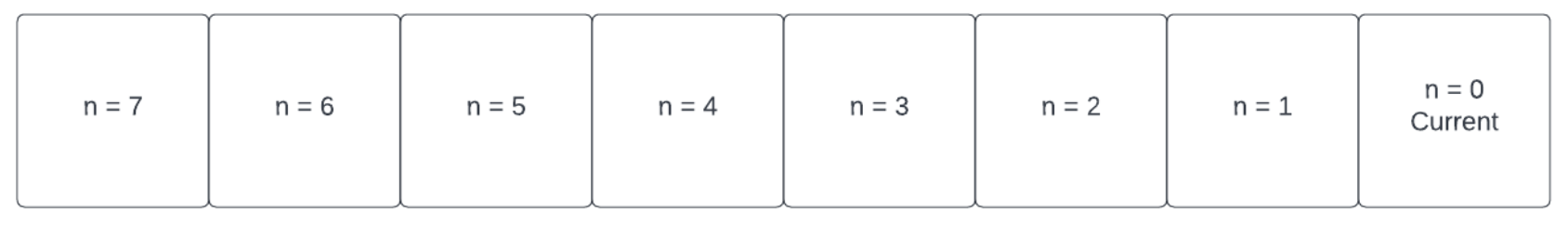

ɑ = smooth / (n + 1); smooth = 6

n = number of previous periods used = 7 (funding interval)

Funding Rate intervals will be the same for all perpetual futures products.

Funding Fee Payment

All settlements will be done in USDC, so all Funding fee payments will be paid and received in USDC.

13. Index Price

The Index Price is the mark price of an index that consists of a bucket of prices from the major Spot Exchanges that trade the particular asset. The index feed is meant to provide a real time view of underlying cryptocurrency prices across trading venues. It is used for the settlement and margining of perpetual futures contracts.

Definitions

Derived Market Price (DMP) = Median(last trade price, last best bid, last best offer) for each venue

Median Derived Market Price (MDMP) = Median(DMPs)

Quality checks

Liveness check: For each constituent a liveness check is done, by excluding the constituent to the index if a constituent has no update for 10 seconds

Liquidity check: only compute index if at least three venues are available or two with one of them being Coinbase

Consensus quality check: if # DMP within [MDMP +/- 10%] < 2 then no index provided

Deviation check: if DMP of a constituent is diverging from MDMP by 40bps or more in absolute value then override with DMP = MDMP +/- 40bps

Computation

Index = Average(DMPs) post checks.

Data Publishing

The index price feed will be made available through a streaming transport with the ability to request latest snapshots and streaming updates. The index price will be updated every 1s.

Index prices are calculated and published every 1 second

14. Mark to Market

Mark to Market (MTM), which is evaluating the value of portfolios over time, will happen at a frequency of 1 second. Each asset and market will go through this process, where all portfolios with active positions will go through a process of recalculating the position exposure and unrealized profit & loss. Calculation of the MTM will be using the CLOB Mark Price.

The Mark to Market will be used to calculate unrealized PnL, flag portfolios violating margin requirements, and trigger any liquidation procedures for flagged portfolios.

15. Settlements

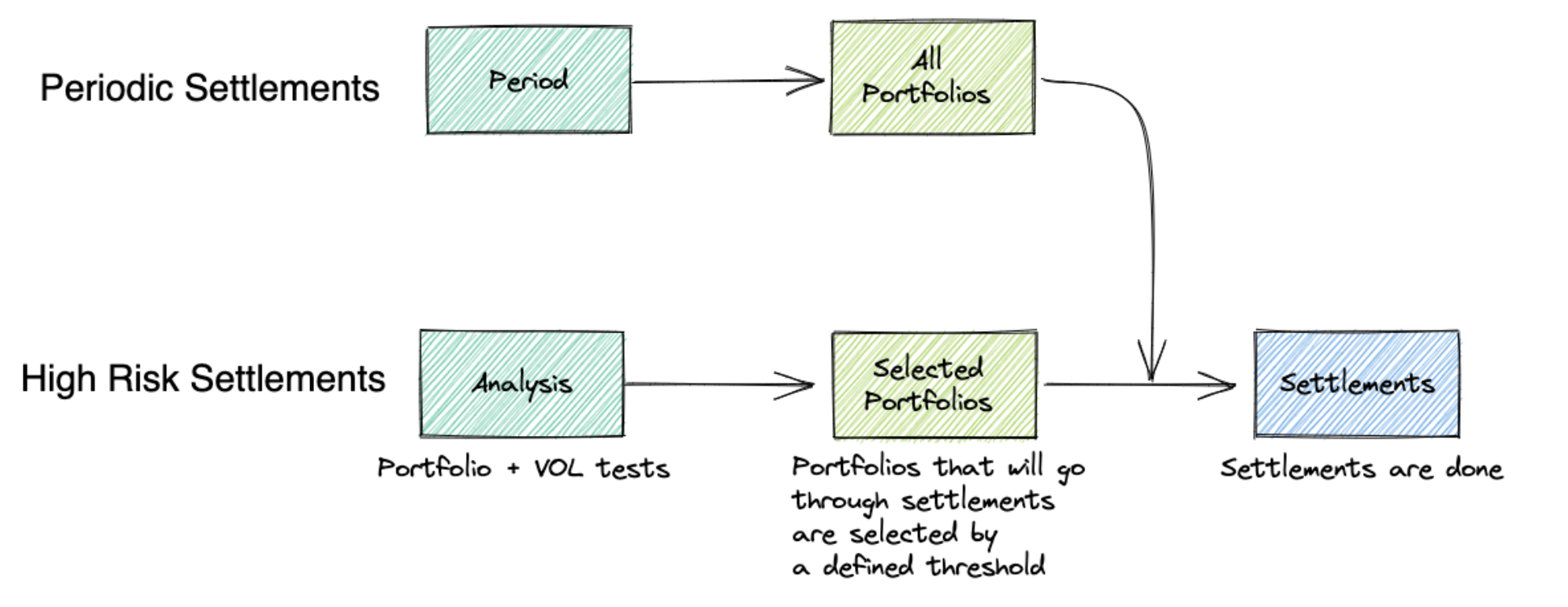

The exchange settles trades every 5 minutes by determining a settlement price and applying it to all positions. This ensures that unrealized profits or losses do not accumulate, reducing risk for customers and the platform. Collateral balances are adjusted based on gains or losses from the settlement price. All settlements on Bermuda Exchange will be done in USDC.

Users will be able to withdraw funds from the platform, which include unrealized PnL.

Settlements will be a combination of the following:

Settlement fund with a trigger to stop withdrawals / transfers

Periodic settlement process: every 5 mins

Filtered settlement: for unrealized losses more than [$10,000 ]

Portfolios will go through a Mark to Market every 1 second.

The threshold for portfolio selection is:

Portfolios that have more than an unrealized loss of $10,000

Settlement fund with a trigger to stop withdrawals / transfers

Periodic settlement process: every 5 mins

Filtered settlement: for unrealized losses more than $10,000

16. Pre-trade risk controls

Sufficient funds check: This control will confirm if the customer has adequate account equity to cover the initial margin for a trade.

Confirm that the client has sufficient funds to execute new positions:

Current Margin > Initial Margin Requirement, where Current Margin only takes into account eligible collateral.

Current Margin is always calculated based on the Worst Case Scenario Logic, where pending open orders are assumed to be executed.

Account Restrictions:

Traders cannot send any new orders if their Current Margin is below maintenance margin requirements.

The user cannot cancel, replace, withdrawal, but can deposit funds into their account to improve their current margin level.

Traders cannot open new risk increasing positions if current margin is below initial margin requirements.

Worst Case Exposure Logic:

The open quantity is defined by the worst case exposure of the position and can be calculated by accumulating existing positions, existing open orders and the new entered order. The worst case exposure is calculated by account level, not portfolio level, which means ALL portfolios within an account that has exposure to a certain market should be considered in the worst case scenario logic.

[WCS Quantity = Size of Existing position + Size of position for existing open orders + Size of positions for new entered order]

2. Price bands: This control will ensure the price impact for a new order does not exceed the FUTURES_PRICE_BAND_LIMIT for futures orders (on the opposite side of the order book).

3. Note: If the new order would cause a price impact to be greater than the defined threshold, 1.5%, the entire order is rejected.

4. Fair value limits: This control will reject market and limit orders if the CLOB Mid Price fluctuates more than 5% from the Futures Fair Value Price. Fair value is measured by the moving average of Spot Index +/- CLOB funding.

The limit will ensure new orders are not executed if the price is outside of the defined range.

[Fair Value ± (Fair Value * Price Band Percentage)] , where the Price Band Percentage is 5%.

5. Maximum position limits: The following limits will ensure the Open Position Notional (“OPN”, measured by Notional ($) and Quantity (#) does not exceed the threshold value, measured by 30D ADQ (“ADQ”) or Open interest (“OI”), for each underlying perpetual future. OPN includes all executed and open orders. New orders will be rejected if they would breach the defined limit.

1) Maximum Position Limit - Per Portfolio - BTCPERP

Notional: MPL = [BTCPERP OPN (Qty x CLOB Price)] <[Max ($1M, 3% of BTCPERP OI)]

Quantity: MPL = [BTCPERP OPN (Qty x CLOB Price)] <[Max (15, 3% of BTCPERP ADQ)]

2) Maximum Position Limit - Per Portfolio - ETHPERP

Notional: MPL = [ETHPERP OPN (Qty x CLOB Price)] <[Max ($1M, 3% of ETHPERP OI)]

Quantity: MPL = [ETHPERP OPN (Qty x CLOB Price)] <[Max (185, 3% of ETHPERP ADQ)]

3) Maximum Notional Limit - Exchange - BTCPERP

MNL: Notional = [Sum (Total BTC-PERP OPN) < [$500M]

4) Maximum Notional Limit - Exchange - ETHPERP

MNL: Notional = [Sum (Total ETH-PERP OPN) < [$500M]

5) Maximum Position Limit - Exchange - BTCPERP

MPL: Quantity = [Sum (Quantity of BTCPERP)] < [X% of OI]

6) Maximum Position Limit - Exchange - ETHPERP

MPL: Quantity = [Sum (Quantity of ETHPERP)] < [X% of OI]

These limits should have their own variables of:

Term | DB Parameter or Code Variable |

|---|---|

Asset Maximum Notional ABS | instrument.position_notional_limit |

Maximum Notional TVR (Trading Volume Ratio) - by asset class | instrument.adv_position_notional_limit_percent |

Maximum Position Limit = MAX (Asset_Max_Notional_ABS, Asset_Max_Notional_TVR * ADTV of underlying perp contract) |

6. Locked account: An account is placed in lock status when the account equity is below certain thresholds. Traders cannot:

Send orders if their account equity is below maintenance margin requirements

Open new positions if account equity is below initial margin requirements

17. Liquidations

Insurance Fund

The purpose of the Insurance Fund is to cover client accounts with negative equity and compensate LSP participants. In the event of liquidation, if the liquidated order is closed at a price worse than the bankruptcy price, the Exchange will use the balance of the insurance fund to cover the loss. If the insurance fund is insufficient, ADL will be triggered. During liquidation, the balance of the insurance fund will increase/decrease depending on the difference in price between the final executed price and the bankruptcy price of the liquidated position.

Further insurance fund is used to cover equity and further compensate Liquidity Provider, following the conditions/equations below:

Insurance Fund covers negative equity of an account by the deficit amount seen in Current Margin ($)

Insurance Fund covers largest customer accounts: ABS (CLOB Mark Price x IM (%) x CoM(%))

Auto Deleveraging

Auto deleveraging occurs when the insurance fund has a positive balance and the accounts being liquidated have negative equity.

Liquidated futures positions are matched against the opposing traders and closed

Top positions size first, and then we match orders against opposing traders

Clawbacks

Clawbacks occur when the insurance fund is depleted and accounts being liquidated have negative equity.

Liquidated futures are matched against opposing traders and auto de-leveraged.

Clawback amount is equal to the negative equity being absorbed by opposing traders.

The amount is determined by the distance between the central limit order book price and the liquidation price.

Pre-liquidation

Triggered when? maintenance margin requirement < Current margin =< Initial margin requirement

Experience to the user? The user can add funds or decrease risk by closing positions in the portfolio, but cannot open positions that increase risk within the portfolio

Auto-liquidations (Controlled liquidations)

Triggered when? close out margin requirement < Current Margin =< maintenance margin requirement

Experience to the user? Users are unable to initiate new orders or withdraw from the platform, however can minimize the Risk by closing open positions or depositing more funds that are acceptable as collateral.

Liquidation Engine focuses on deleveraging and minimizing the corresponding impact to bid / ask spreads. The liquidation algo takes into account the total quantity (across accounts) eligible for liquidation versus liquidity in the CLOB, and has random functions for quantity and price to mitigate any potential pattern signaling. Algo reduces positions until Current Margin % is higher than Initial Margin %, where there is an average daily maximum of liquidations that 1% of the 30D ADTV. Liquidation aims to unwind the minimal quantity of future contracts that would bring Current Margin (%) above Initial Margin (%).

Auto-liquidations are executed in the following order:

Cancel all open orders

Close smaller size positions (Threshold: $5K, Position Size < $5K)

AUTOLIQ_MIN_SIZE = $5,000

Immediate-Or-Cancel (IOC) orders based on lowest/highest price to bring Current Margin % back above the Initial Margin %

Liquidate futures positions first, and then non-USDC collateral

Close larger size positions (Threshold: $5K, Position Size > $5K)

IOC orders are determined based on a percentage of position size. IOC orders are reduced into smaller orders and randomization logic is used to determine spreads. IOC orders are executed ~1 minute. First, we liquidate the futures positions and then collateral (USDC).

Liquidation price and quantity are randomized. The order should have the following size and price:

Size: MAX ( $5K, AUTOLIQ_POSITION_FRACTION * Position ($) x RAND [AUTOLIQ_POSITION_MULTIPLIER_MIN ~ AUTOLIQ_POSITION_MULTIPLIER_MAX])

AUTOLIQ_POSITION_FRACTION = 10%

AUTOLIQ_POSITION_MULTIPLIER_MIN = 0.5

AUTOLIQ_POSITION_MULTIPLIER_MAX = 1.5

Price: Opposite Top of Book ± (1 to 5 bps)

If Liquidation are LONG then Best Ask + (1 to 5bps)

If Liquidation are SHORT then Best Bid - (1 to 5bps)

Executed within 6 sec (randomly 1 - 6 seconds) of Order Process repeats until order is closed or CM % > IM%

AUTO_LIQ_EXECUTION_INTERVAL = 6 sec

Entire position is aimed to be closed within 1 minute.

Asset (Perp Market) | AUTOLIQ_MIN_SIZE |

|---|---|

BTC | $5,000 |

ETH | $5,000 |

Action: Even if the price of contract (BTC-PERP or ETH-PERP) improves leading the user’s Current Margin to be above the Maintenance Requirement, this does not stop the liquidation process and liquidations will continue until the Current Margin exceeds Initial Margin.

The liquidation engine formula is as follows:

Liquidation Example | |

|---|---|

Step 1 | Engine quantifies the quantity to partially liquidate the position and bring account equity back to IMR, assuming a -10.1% price decline, the notional to liquidate is ~$8.3mm, assuming BTC price at liquidation is $14,440, the quantity to liquidate is 579 BTC equivalent. |

Step 2 | The engine knows it needs to liquidate ~$8.3mm notional (579 BTC) to liquidate and sets the parent order as the size, but it is likely to set smaller child orders as it then applies the following logic: MAX ($5k notional, 10% of parent order) but capped at 1% of the 30D ADTV. Let’s assume the governing criteria for a user is $830k (10% of parent order), the child order amount of $830k then is factored +/- within a range of .5x to 1.5x – meaning, a number between .5 and 1.5 will be selected randomly and that number will be multiplied by the $830k. This is done to ensure patterns are not detectable given random factor. |

Step 3 | The engine then sends a limit IOC to sell on behalf of the user and the quantity that was filled is deducted from the parent order amount of ~$8.3mm (579 BTC) and the process repeats until the users equity equals IMR. |

Liquidity Support Program (LSP) Liquidations

Triggered when? Current Margin is less than or equal to the Close out Margin

Experience to the user? N/A

Liquidity Support Program is a part of the liquidation waterfall, where selected trading firms are responsible for taking over positions being liquidated programmatically and in real time. The LSP participants need to pledge capital to take on positions in a segregated account to take on liquidations. The participation for this program is initially capped at 10 participants.

Step 1: LSP has capacity to take liquidated positions related to liquidated accounts with positive equity:

At this stage, the Insurance fund has a positive balance and the accounts in liquidation have positive equity.

Liquidation aims to unwind the minimal quantity of future contracts that would bring Current Margin (%) above Initial Margin (%) and processes partial or full liquidation.

Full liquidations occur the moment accounts in scope for assignment begin to incur negative equity.

Liquidated futures are transferred to LSP outside of the order book at the negative equity price.

LSP participants receive orders following price formulas, and receive 60% of CoM. 40% x CoM($) is used to fund the insurance fund. LSP participants absorb positions when account equity is less than or equal to CoM

60% of CoM → LSP Assignment

LP_ALLOCATION_RATIO = 0.6

40% of CoM → Insurance Fund

IF_ALLOCATION_RATIO = 0.4

Step 2: LSP can take on positions related to liquidated accounts with negative equity:

Insurance fund has a positive balance and liquidated accounts have negative equity.

Futures positions are fully liquidated at the liquidation price and transferred to Liquidity Providers at the Transfer Price.

Insurance fund is utilized to cover equity and further compensate Liquidity Providers, following the formulas provided above.

Insurance Fund Covers Negative Equity Account: Deficit amount represented in Current Margin ($)

Insurance Fund covers LSP: ABS (CLOB x IM (%) x CoM(%))

Step 3: Liquidity Providers have no capacity to take liquidated positions. Liquidated futures are matched against opposing accounts:

The Insurance Fund has a positive balance and the accounts in liquidation have positive equity.

Liquidation aims to unwind the minimal quantity of future contracts that would bring Current Margin (%) above Initial Margin (%).

Liquidated futures are matched against opposing traders. Partial or full liquidation occurs against Open Interest.

Futures are assigned to opposing traders at the Transfer Price. Customers impacted receive a portion of the residual equity remaining from liquidated accounts, and the remainder goes towards the insurance fund.

Full liquidation occurs when central limit order book future prices are below “liquidation price”.

Liquidation Price

Liquidation Price = IF(OPN>0,(CLOB Price)*(1-Initial Margin %), CLOB price*(1+Initial Margin %))

Transfer Price

If Long: Min {(60% x LP + 40% x CLOB) , (CLOB x [1 - IM(%) x (CoM(%)])}

If Short: Max {(60% x LP + 40% x CLOB) , (CLOB x [1 - IM(%) x (CoM(%)])}

Auto-Close

Position Size = MAX ( $ 1k , (1 -{Current Margin (%) / Close Out Margin(%)}) * Open Position Notional )

Requirements for Liquidity Support Program The participant must apply and sign an agreement with CIE to participate in the LSP

Pre-fund a minimum balance of $1M in USDC in a separate, segregated account from their standard market making account on CB Intl Exchange;

Maintain a minimum balance of $1M in USDC at all time with a 48 hours grace period [“we reserve the right to remove you from the program and reallocate your slot to another participant”]

Withdrawal: 14d notice

Maintain a separate, segregated account from any normal market making activity

Pre-fund this segregated account with unencumbered funds to ensure they cannot walk away from their commitments

Agree to the upfront transfer pricing and mechanics

Mechanics - Assignment Distribution

Positions that are transferred to the LSP participants do not display publicly as public orders.

LSP participants are all treated equal for assignment: system will look to split the assigned liquidation pro rata of their contribution among total LSP contributions.

Pro rata shares shall be determined by the following formula expressed as a percentage: LSP LC / Agg LSP LC

“LSP LC” equals the Current Margin of the participant in the Program

“Agg LSP LC” equals the aggregate amount of LSP LC for all participants in the Program. Agg LSP LC shall be determined by the Exchange in its sole discretion.

Maximum leverage for LSP account will be 2x, however the Maintenance Margin and Close Out Margin will remain at 13% and 6.7%, respectively. If participants put the minimum $1mm commitment, they will be on the hook for $2mm notional in fills (2x leverage).

18. Pre-Launch Futures Conversions

Conversion Process: When the underlying pre-launch future token is launched on applicable spot exchanges and the market meets our requirements for a standard perpetual future, Coinbase will begin converting the pre-launch market to a standard perpetual future market. For more information on Pre-Launch Futures products, please visit our help centre.

19. Perpetual Futures Delistings on Coinbase International Exchange

The following information outlines the process that Coinbase International Exchange will follow for the delisting of perpetual futures contracts.

19.1 Announcement Process

19.1.1 Public Announcement

Coinbase will issue a public announcement via the below designated channels:

X (formerly Twitter)

Email (for institutional and retail clients)

Statuspage

The announcement will specify the key dates and specific delisting details:

The Lead Time, which is the period between the announcement and the trading suspension, will have a default value of 14 days. However, Coinbase reserves the right to adjust the Lead Time at its discretion.

Trading Suspension & Final Settlement Time: This is the time at which all trading activity ceases and positions are automatically settled.

Final Settlement Price: This is the pricing methodology used to settle all positions.

19.2 Trading Suspension & Final Settlement

19.2.1 Trading Suspension

At the Trading Suspension & Final Settlement Time, the following actions occur:

Trading is fully suspended

New orders are automatically rejected.

Any open orders are canceled.

19.2.2 Final Settlement

All open positions are closed using the Final Settlement Price, calculated as the average Index Price from the last 60 minutes leading up to the Trading Suspension & Final Settlement Time.

Customers who do not close positions before Trading Suspension and Final Settlement Time will be subject to automatic settlement at Final Settlement Price.

19.3 Final Settlement Price Calculation

19.3.1 Default Settlement Price

The Default Final Settlement Price is the average Index Price calculated over the last 60 minutes prior to the Trading Suspension & Final Settlement Time. (Please be advised that the funding rate will be set to 0 before the final settlement period begins, so there is no funding payment at settlement).

19.3.2 Discretionary Adjustment

Coinbase reserves the right to adjust the methodology or time period used to calculate the Final Settlement Price in cases of market abnormalities or other extenuating circumstances.

19.4 Trading Suspension

Coinbase reserves the right to suspend trading at any time, either on or before the scheduled Trading Suspension & Final Settlement Time, in cases of unexpected market conditions, technical issues, or any other reason Coinbase deems necessary to protect market integrity as provided in rule 2.22.

19.5 Trading Fees

Standard trading fees apply to positions that are automatically settled during the delisting process.